Starwood 2008 Annual Report Download - page 149

Download and view the complete annual report

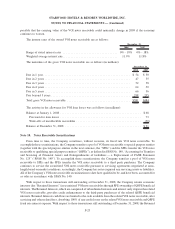

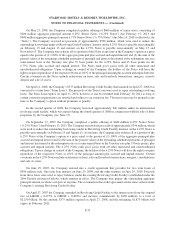

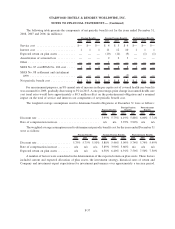

Please find page 149 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On May 23, 2008, the Company completed a public offering of $600 million of senior notes, consisting of

$200 million aggregate principal amount 6.25% Senior Notes (“6.25% Notes”) due February 15, 2013 and

$400 million aggregate principal amount 6.75% Senior Notes (“6.75% Notes”) due May 15, 2018 (collectively, the

“Notes”). The Company received net proceeds of approximately $596 million, which were used to reduce the

outstanding borrowings under its Revolving Credit Facilities. Interest on the 6.25% Notes is payable semi-annually

on February 15 and August 15 and interest on the 6.75% Notes is payable semi-annually on May 15 and

November 15. The Company may redeem all or a portion of the Notes at any time at the Company’s option at a price

equal to the greater of (1) 100% of the aggregate principal plus accrued and unpaid interest and (2) the sum of the

present values of the remaining scheduled payments of principal and interest discounted at the redemption rate on a

semi-annual basis at the Treasury rate plus 35 basis points for the 6.25% Notes and 45 basis points for the

6.75% Notes, plus accrued and unpaid interest. The Notes rank parri passu with all other unsecured and

unsubordinated obligations. Upon a change in control of the Company, the holders of the Notes will have the

right to require repurchase of the respective Notes at 101% of the principal amount plus accrued and unpaid interest.

Certain covenants on the Notes include restrictions on liens, sale and leaseback transactions, mergers, consoli-

dations and sale of assets.

On April 11, 2008, the Company’s $375 million Revolving Credit Facility that matured on April 27, 2008 was

converted to a term loan (“Term Loan”). The proceeds of the Term Loan were used to repay outstanding revolving

loans. The Term Loan expires on April 11, 2010, however, it can be extended until February 10, 2011 as long as

certain extension requirements are satisfied and subject to an extension fee. The term loans may be prepaid at any

time at the Company’s option without premium or penalty.

In the second quarter of 2008, the Company borrowed approximately $66 million under an international

revolving credit facility, which was repaid during the fourth quarter of 2008 in conjunction with the sale of three

properties by the Company (see Note 17).

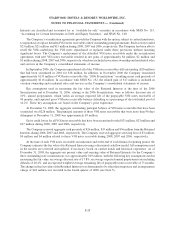

On September 13, 2007, the Company completed a public offering of $400 million 6.25% Senior Notes

(“6.25% Notes”) due February 13, 2013. The Company received net proceeds of approximately $396 million, which

were used to reduce the outstanding borrowings under its Revolving Credit Facility. Interest on the 6.25% Notes is

payable semi-annually on February 15 and August 15. At any time, the Company may redeem all or a portion of the

6.25% Notes at the Company’s option at a price equal to the greater of (1) 100% of the aggregate principal plus

accrued and unpaid interest and (2) the sum of the present values of the remaining scheduled payments of principal

and interest discounted at the redemption rate on a semi-annual basis at the Treasury rate plus 35 basis points, plus

accrued and unpaid interest. The 6.25% Notes rank parri passu with all other unsecured and unsubordinated

obligations. Upon a change in control of the Company, the holders of the 6.25% Notes will have the right to require

repurchase of the respective Notes at 101% of the principal amount plus accrued and unpaid interest. Certain

covenants in the 6.25% Notes include restrictions on liens, sale and leaseback transactions, mergers, consolidations

and sale of assets.

On June 29, 2007, the Company entered into a credit agreement that provides for two term loans of

$500 million each. One term loan matures on June 29, 2009, and the other matures on June 29, 2010. Proceeds

from these loans were used to repay balances under the existing Revolving Credit Facility (established under the

2006 Facility referenced below), which remains in effect. The Company may prepay the outstanding aggregate

principal amount, in whole or in part, at any time. The covenants in this credit agreement are the same as those in the

Company’s existing Revolving Credit Facility.

On April 27, 2007 the Company amended its Revolving Credit Facility to the interest rate (from the original

rate of LIBOR + 0.475% to LIBOR + 0.400%) and increase commitments by $450 million, to a total of

$2.250 billion. Of this amount, $375 million expired on April 27, 2008, and the remaining $1.875 billion will

expire in February 2011.

F-33

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)