Starwood 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued SFAS No. 141 (revised 2007) (SFAS 141(R)), “Business Combinations,”

which is a revision of SFAS 141, “Business Combinations.” The primary requirements of SFAS 141(R) are as

follows: (i.) Upon initially obtaining control, the acquiring entity in a business combination must recognize 100% of

the fair values of the acquired assets, including goodwill, and assumed liabilities, with only limited exceptions even

if the acquirer has not acquired 100% of its target. As a consequence, the current step acquisition model will be

eliminated. (ii.) Contingent consideration arrangements will be fair valued at the acquisition date and included on

that basis in the purchase price consideration. The concept of recognizing contingent consideration at a later date

when the amount of that consideration is determinable beyond a reasonable doubt, will no longer be applicable. (iii.)

All transaction costs will be expensed as incurred. SFAS 141 (R) is effective as of the beginning of an entity’s first

fiscal year beginning after December 15, 2008. Adoption is prospective and early adoption is not permitted.

In December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial

Statements — An Amendment of ARB No. 51, or SFAS No. 160.” SFAS No. 160 establishes new accounting and

reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary.

SFAS No. 160 is effective for fiscal years beginning on or after December 15, 2008. The Company does not believe

that SFAS 160 will have a material impact on the consolidated financial statements.

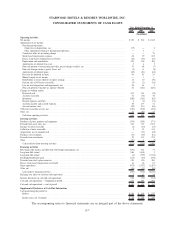

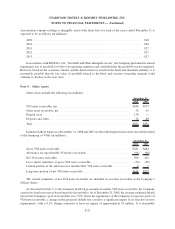

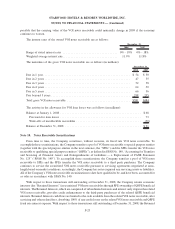

Note 3. Earnings per Share

The following is a reconciliation of basic earnings per Share to diluted earnings per Share for income from

continuing operations (in millions, except per Share data):

Earnings Shares

Per

Share Earnings Shares

Per

Share Earnings Shares

Per

Share

2008 2007 2006

Year Ended December 31,

Basic earnings from continuing operations .......... $254 181 $1.40 $543 203 $2.67 $1,115 213 $5.25

Effect of dilutive securities:

Employee options and restricted stock awards ...... — 4 — 8 — 9

Convertible debt . . . ....................... — — — — — 1

Diluted earnings from continuing operations ......... $254 185 $1.37 $543 211 $2.57 $1,115 223 $5.01

Approximately 7 million Shares, 1 million Shares and 2 million Shares were excluded from the computation of

diluted Shares in 2008, 2007 and 2006, respectively, as their impact would have been anti-dilutive.

On March 15, 2006, the Company completed the redemption of the remaining 25,000 shares of Class B

Exchangeable Preferred Shares of the Trust (“Class B EPS”) for approximately $1 million. In April 2006, the

Company completed the redemption of the remaining 562,000 shares of Class A Exchangeable Preferred Shares of

the Trust (“Class A EPS”) for approximately $33 million. For the period prior to the redemption dates,

157,000 shares of Class A and Class B EPS are included in the computation of basic Shares for the year ended

December 31, 2006.

Prior to June 5, 2006, the Company had contingently convertible debt, the terms of which allowed for the

Company to redeem such instruments in cash or Shares. The Company, in accordance with SFAS No. 128,

“Earnings per Share,” utilized the if-converted method to calculate dilution once certain trigger events were met.

One of the trigger events for the Company’s contingently convertible debt was met during the first quarter of 2006

when the closing sale price per Share was $60 or more for a specified length of time. On May 5, 2006, the Company

gave notice of its intention to redeem the convertible debt on June 5, 2006. Under the terms of the convertible

indenture, prior to this redemption date, the note holders had the right to convert their notes into Shares at the stated

conversion rate. Under the terms of the indenture, the Company settled conversions by paying the principal portion

of the notes in cash and the excess amount of the conversion spread in Corporation Shares. For the period prior to the

F-17

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)