Starwood 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

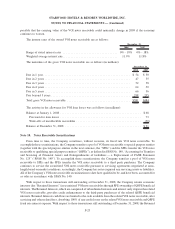

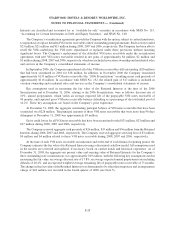

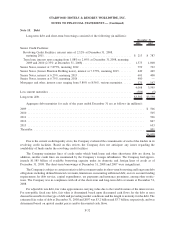

Amortization expense relating to intangible assets with finite lives for each of the years ended December 31 is

expected to be as follows (in millions):

2009 . .................................................................. $28

2010 . .................................................................. $28

2011 . .................................................................. $27

2012 . .................................................................. $27

2013 . .................................................................. $27

In accordance with SFAS No. 142, “Goodwill and Other Intangible Assets”, the Company performed its annual

impairment test of goodwill for both of its reporting segments and concluded that the goodwill was not impaired.

However, based on the economic climate and the deterioration of results in the hotel and timeshare industry, it is

reasonably possible that the fair value of goodwill related to the hotel and vacation ownership segment could

continue to decline in the near term.

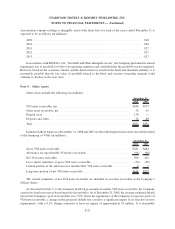

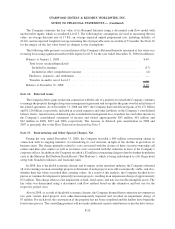

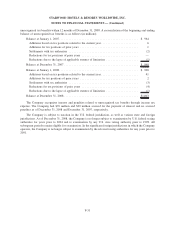

Note 9. Other Assets

Other assets include the following (in millions):

2008 2007

December 31,

VOI notes receivable, net ............................................. $444 $373

Other notes receivable, net ............................................ 32 41

Prepaid taxes ...................................................... 130 —

Deposits and other .................................................. 76 80

Total ............................................................ $682 $494

Included in these balances at December 31, 2008 and 2007 are the following fixed rate notes receivable related

to the financing of VOIs (in millions):

2008 2007

December 31,

Gross VOI notes receivable ........................................... $581 $484

Allowance for uncollectible VOI notes receivable ........................... (91) (68)

Net VOI notes receivable ............................................. 490 416

Less current maturities of gross VOI notes receivable ........................ (54) (50)

Current portion of the allowance for uncollectible VOI notes receivable........... 8 7

Long-term portion of net VOI notes receivable ............................. $444 $373

The current maturities of net VOI notes receivable are included in accounts receivable in the Company’s

balance sheets.

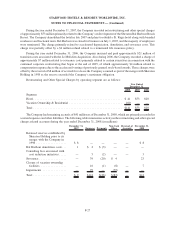

As discussed in Note 2, as the Company holds large amounts of similar VOI notes receivable, the Company

assesses its loan loss reserves based on pools of receivables. As of December 31, 2008, the average estimated default

rate for the Company’s pool of receivables was 7.9%. Given the significance of the Company’s respective pools of

VOI notes receivable, a change in the projected default rate can have a significant impact to its loan loss reserve

requirements, with a 0.1% change estimated to have an impact of approximately $3 million. It is reasonably

F-22

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)