Starwood 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

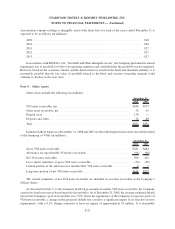

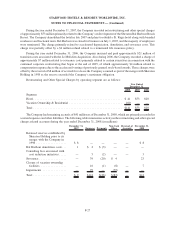

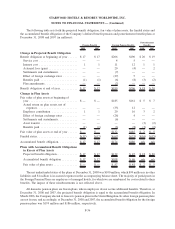

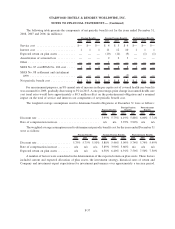

unrecognized tax benefits within 12 months of December 31, 2008. A reconciliation of the beginning and ending

balance of unrecognized tax benefits is as follows (in millions):

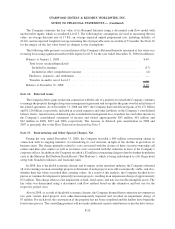

Balance at January 1, 2007................................................. $ 964

Additions based on tax positions related to the current year ....................... 6

Additions for tax positions of prior years .................................... 1

Settlements with tax authorities . . ......................................... (2)

Reductions for tax positions of prior years ................................... —

Reductions due to the lapse of applicable statutes of limitation .................... (1)

Balance at December 31, 2007 .............................................. $ 968

Balance at January 1, 2008................................................. $ 968

Additions based on tax positions related to the current year ....................... 41

Additions for tax positions of prior years .................................... 2

Settlements with tax authorities . . ......................................... (3)

Reductions for tax positions of prior years ................................... (4)

Reductions due to the lapse of applicable statutes of limitation .................... (1)

Balance at December 31, 2008 .............................................. $1,003

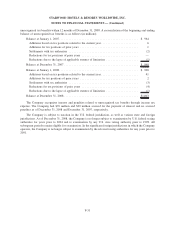

The Company recognizes interest and penalties related to unrecognized tax benefits through income tax

expense. The Company had $76 million and $29 million accrued for the payment of interest and no accrued

penalties as of December 31, 2008 and December 31, 2007, respectively.

The Company is subject to taxation in the U.S. federal jurisdiction, as well as various state and foreign

jurisdictions. As of December 31, 2008, the Company is no longer subject to examination by U.S. federal taxing

authorities for years prior to 2004 and to examination by any U.S. state taxing authority prior to 1998. All

subsequent periods remain eligible for examination. In the significant foreign jurisdictions in which the Company

operates, the Company is no longer subject to examination by the relevant taxing authorities for any years prior to

2001.

F-31

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)