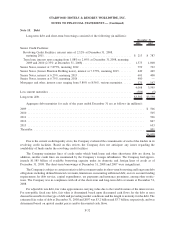

Starwood 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

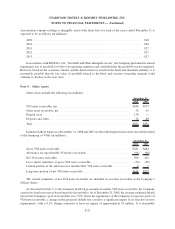

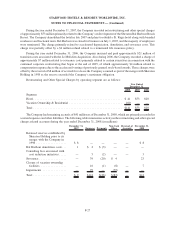

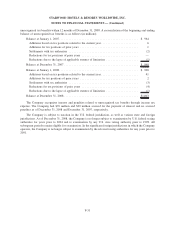

During the year ended December 31, 2007, the Company recorded net restructuring and other special charges

of approximately $53 million primarily related to the Company’s redevelopment of the Sheraton Bal Harbour Beach

Resort. The Company demolished the hotel in late 2007 and plans to rebuild a St. Regis hotel along with branded

residences and fractional units. Bal Harbour was closed for business on July 1, 2007, and the majority of employees

were terminated. The charge primarily related to accelerated depreciation, demolition, and severance costs. This

charge was partially offset by a $2 million refund related to a terminated life insurance policy.

During the year ended December 31, 2006, the Company incurred and paid approximately $21 million of

transition costs associated with the Le Méridien Acquisition. Also during 2006, the Company recorded a charge of

approximately $7 million related to severance costs primarily related to certain executives in connection with the

continued corporate restructuring that began at the end of 2005, of which approximately $4 million related to

compensation expense due to the accelerated vesting of previously granted stock-based awards. These charges were

offset by the reversal of $8 million of accruals for a lease the Company assumed as part of the merger with Sheraton

Holding in 1998 as the reserve exceeded the Company’s maximum obligation.

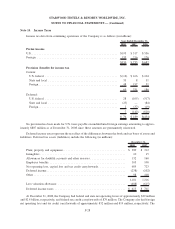

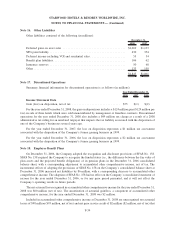

Restructuring and Other Special Charges by operating segment are as follows:

2008 2007 2006

Year Ended

December 31,

Segment

Hotel ....................................................... $ 41 $53 $20

Vacation Ownership & Residential ................................. 100 — —

Total ....................................................... $141 $53 $20

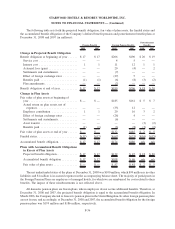

The Company had remaining accruals of $41 million as of December 31, 2008, which are primarily recorded in

accrued expenses and other liabilities. The following table summarizes activity in the restructuring and other special

charges related accounts during the year ended December 31, 2008 (in millions):

December 31,

2007 Expenses Payments

Non-Cash

Other

Reversal of

Accruals

December 31,

2008

Retained reserves established by

Sheraton Holding prior to its

merger with the Company in

1998 ................... $ 8 — — — — $ 8

Bal Harbour demolition costs . . . 1 $ 2 $ (3) — — —

Consulting fees associated with

cost reduction initiatives ..... — 5 (2) — — 3

Severance ................. — 39 (20) $ 4 23

Closure of vacation ownership

facilities................. — 16 (1) (8) — 7

Impairments ............... — 79 — (79) — —

Total ..................... $ 9 $141 $(26) $(83) — $41

F-27

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)