Starwood 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

possible that the carrying value of the VOI notes receivable could materially change in 2009 if the economy

continues to worsen.

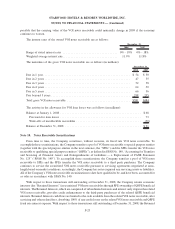

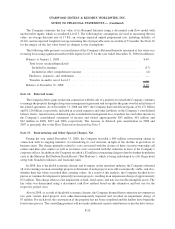

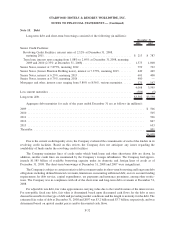

The interest rates of the owned VOI notes receivable are as follows:

2008 2007

December 31,

Range of stated interest rates .................................. 0%-18% 0%-18%

Weighted average interest rate.................................. 11.9% 11.8%

The maturities of the gross VOI notes receivable are as follows (in millions):

2008 2007

December 31,

Due in 1 year...................................................... $ 54 $ 50

Due in 2 years ..................................................... 47 35

Due in 3 years ..................................................... 52 38

Due in 4 years ..................................................... 64 50

Due in 5 years ..................................................... 66 56

Due beyond 5 years ................................................. 298 255

Total gross VOI notes receivable ....................................... $581 $484

The activity in the allowance for VOI loan losses was as follows (in millions):

Balance at January 1, 2008 .................................................. $68

Provision for loan losses .................................................. 73

Write-offs of uncollectible receivables ........................................ (50)

Balance at December 31, 2008 ............................................... $91

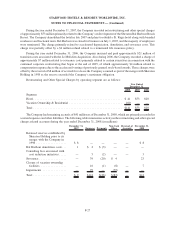

Note 10. Notes Receivable Securitizations

From time to time, the Company securitizes, without recourse, its fixed rate VOI notes receivable. To

accomplish these securitizations, the Company transfers a pool of VOI notes receivable to special purpose entities

(together with the special purpose entities in the next sentence, the “SPEs”) and the SPEs transfer the VOI notes

receivable to qualifying special purpose entities (“QSPEs”), as defined in SFAS No. 140, “Accounting for Transfers

and Servicing of Financial Assets and Extinguishments of Liabilities — a Replacement of FASB Statement

No. 125” (“SFAS No. 140”). To accomplish these securitizations, the Company transfers a pool of VOI notes

receivable to SPEs and the SPEs transfer the VOI notes receivable to a third party purchaser. The Company

continues to service the securitized VOI notes receivable pursuant to servicing agreements negotiated at arms-

length based on market conditions; accordingly, the Company has not recognized any servicing assets or liabilities.

All of the Company’s VOI notes receivable securitizations to date have qualified to be, and have been, accounted for

as sales in accordance with SFAS No. 140.

With respect to those transactions still outstanding at December 31, 2008, the Company retains economic

interests (the “Retained Interests”) in securitized VOI notes receivables through SPE ownership of QSPE beneficial

interests. The Retained Interests, which are comprised of subordinated interests and interest only strips in the related

VOI notes receivable, provides credit enhancement to the third-party purchasers of the related QSPE beneficial

interests. Retained Interests cash flows are limited to the cash available from the related VOI notes receivable, after

servicing and other related fees, absorbing 100% of any credit losses on the related VOI notes receivable and QSPE

fixed rate interest expense. With respect to those transactions still outstanding at December 31, 2008, the Retained

F-23

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)