Starwood 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

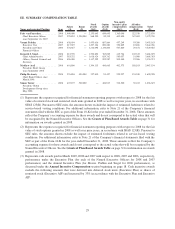

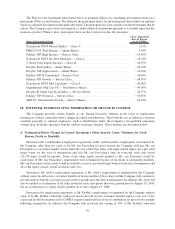

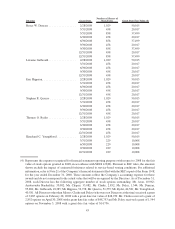

The Plan uses the investment funds listed below as potential indices for calculating investment returns on a

participant’s Plan account balance. The deferrals the participant directs for investment into these funds are adjusted

based on a deemed investment in the applicable funds. The participant does not actually own the investments that he

selects. The Company may, but is not required to, make identical investments pursuant to a variable universal life

insurance product. When it does, participants have no direct interest in this life insurance.

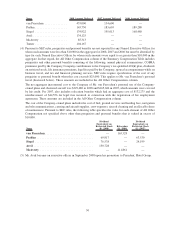

Name of Investment Fund

1-Year Annualized

Rate of Return

(as of 2/28/09)

Nationwide NVIT Money Market — Class V............................. 1.19%

PIMCO VIT Total Return — Admin Shares .............................. 0.94%

Fidelity VIP High Income — Service Class .............................. ⫺19.01%

Nationwide NVIT Inv Dest Moderate — Class 2 .......................... ⫺28.74%

T. Rowe Price Equity Income — Class II................................ ⫺46.97%

Dreyfus Stock Index — Initial Shares .................................. ⫺43.63%

Dreyfus VIF Appreciation — Initial Shares .............................. ⫺36.42%

Fidelity VIP II Contrafund — Service Class ............................. ⫺46.44%

Fidelity VIP Growth — Service Class .................................. ⫺48.97%

Nationwide NVIT Mid Cap Index — Class I ............................. ⫺42.48%

Oppenheimer Mid Cap VA — Non-Service Shares ......................... ⫺49.50%

Dreyfus IP Small Cap Stock Index — Service Shares....................... ⫺42.57%

Fidelity VIP Overseas — Service Class ................................. ⫺50.85%

AIM V.I. International Growth — Series I Shares.......................... ⫺42.54%

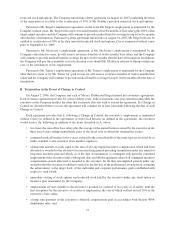

IX. POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

The Company provides certain benefits to our Named Executive Officers in the event of employment

termination, both in connection with a change in control and otherwise. These benefits are in addition to benefits

available generally to salaried employees, such as distributions under the Company’s tax-qualified retirement

savings plan, disability insurance benefits and life insurance benefits. These benefits are described below.

A. Termination Before Change in Control: Involuntary Other than for Cause, Voluntary for Good

Reason, Death or Disability

Pursuant to Mr. van Paaschen’s employment agreement, if Mr. van Paasschen’s employment is terminated by

the Company other than for cause or by Mr. van Paasschen for good reason, the Company will pay Mr. van

Paasschen as a severance benefit (i) two times the sum of his base salary and target annual bonus, (ii) a pro rated

target bonus for the year of termination and (iii) Mr. van Paasschen’s sign on restricted stock unit award

(25,558 units) would be payable. None of the other equity awards granted to Mr. van Paasschen would be

accelerated. If Mr. van Paasschen’s employment were terminated because of his death or permanent disability,

Mr. van Paasschen (or his estate) would be entitled to receive a pro rated target bonus for the year of termination and

all of his equity awards would accelerate and vest.

Pursuant to Mr. Avril’s employment agreement, if Mr. Avril’s employment is terminated by the Company

without cause, he will receive severance benefits of twelve months of base salary and the Company will continue to

provide medical benefits coverage for up to twelve months after the date of termination. In addition, Mr. Avril will

also be entitled to acceleration of all of his restricted stock and options that were granted prior to August 19, 2008,

but no acceleration for equity awards granted on or after August 19, 2008.

Pursuant to his employment agreement, if Mr. Prabhu’s employment is terminated by the Company without

cause or by Mr. Prabhu voluntarily with good reason, he will receive severance benefits equal to one year’s base

salary and he will be reimbursed for COBRA expenses minus his last level of contribution for up to twelve months

following termination. In addition, the Company will accelerate the vesting of 50% of Mr. Prabhu’s unvested

36