Starwood 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.concepts owned by the venture will be available for Starwood’s upper-upscale and luxury hotel brands including W,

Westin, Le Meridien and St. Regis. Additionally, the venture may own and operate freestanding restaurants outside

of Starwood’s hotels. Starwood invested approximately $22 million in this venture for a 32.7% equity interest.

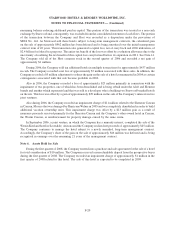

Note 5. Asset Dispositions and Impairments

During 2008, as a result of the current economic climate, the Company reviewed the recoverability of its

carrying values of its owned hotels and concluded that five hotels were impaired. These hotels are non-Starwood

branded hotels, in which the Company has no intention to invest significant capital and operating income has

deteriorated significantly. The fair values of the hotels were estimated by using comparative sales for similar assets

and recent letters of intent to sell certain assets. An impairment charge of $64 million was recorded in the year ended

December 31, 2008 associated with these hotels. These assets are reported in the Hotels operating segment. It is

reasonably possible that there will be additional impairments on owned hotels in 2009 if economic conditions

worsen.

During 2008, as a result of current market conditions and its impact on the timeshare industry, the Company

reviewed the fair value of its economic interests in securitized VOI notes receivable and concluded these interests

were impaired. The fair value of the Company’s investment in these retained interests was determined by estimating

the net present value of the expected future cash flows, based on expected default and prepayment rates (See

Note 10.) The Company recorded an impairment charge of $22 million in the year ended December 31, 2008 related

to these retained interests. These assets are reported in the Vacation Ownership and Residential operating segment.

During the fourth quarter of 2008, the Company sold The Westin Turnberry for net cash proceeds of

$99 million. This sale was subject to a long term management contract and the Company recorded a deferred gain of

$27 million in connection with the sale.

During the third quarter of 2008, the Company recorded a loss of $11 million primarily related to an investment

in which the Company holds a minority interest. This investment was fully written off as the joint venture’s lenders

began foreclosure proceedings on the underlying assets of the venture.

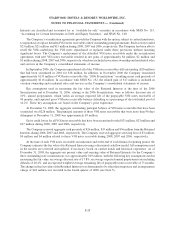

During 2007, the Company recorded a net loss of $44 million, primarily related to a net loss of $58 million on

the sale of eight wholly owned hotels and a loss of approximately $7 million primarily related to charges at three

other properties. These losses were offset in part by $20 million of net gains primarily on the sale of assets in which

the Company held a minority interest and a gain of $6 million as a result of insurance proceeds received for property

damage caused by storms at two owned hotels in prior years.

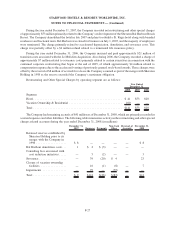

During the second quarter of 2006, the Company consummated the Host Transaction whereby subsidiaries of

Host acquired 33 properties and the stock of certain controlled subsidiaries, including Sheraton Holding and the

Trust. The stock and cash transaction was valued at approximately $4.1 billion, including debt assumption (based on

Host’s closing stock price on April 7, 2006 of $20.53). In the first phase of the transaction, 28 hotels and the stock of

certain controlled subsidiaries, including Sheraton Holding and the Trust, were acquired by Host for consideration

valued at $3.54 billion. On May 3, 2006, four additional hotels located in Europe were sold to Host for net proceeds

of approximately $481 million in cash. On June 13, 2006, the final hotel in Venice, Italy was sold to Host for net

proceeds of approximately $74 million in cash. In connection with the first phase of the transaction, Starwood

shareholders received approximately $2.8 billion in the form of Host common stock valued at $2.68 billion and

$119 million in cash for their Class B shares. Based on Host’s closing price on April 7, 2006, this consideration had

a per — Class B share value of $13.07. Starwood directly received approximately $738 million of consideration in

the first phase, including $600 million in cash, $77 million in debt assumption and $61 million in Host common

stock. In addition, the Corporation assumed from its subsidiary, Sheraton Holding, debentures with a principal

balance of $600 million. As the sale of the Class B shares involved a transaction with Starwood’s shareholders, the

book value of the Trust associated with this sale was treated as a non-reciprocal transaction with owners and was

removed through retained earnings up to the amount of retained earnings that existed at the sale date with the

F-19

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)