Starwood 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

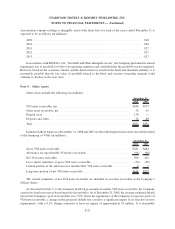

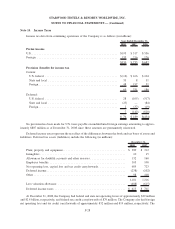

Note 14. Income Taxes

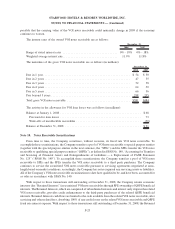

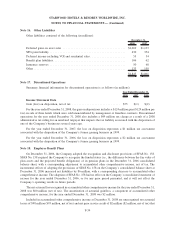

Income tax data from continuing operations of the Company is as follows (in millions):

2008 2007 2006

Year Ended December 31,

Pretax income

U.S...................................................... $195 $ 517 $ 556

Foreign................................................... 135 216 126

$330 $ 733 $ 682

Provision (benefit) for income tax

Current:

U.S. federal ............................................. $(12) $ 166 $ 104

State and local ........................................... 33 8 31

Foreign ................................................. 48 157 51

69 331 186

Deferred:

U.S. federal ............................................. 28 (105) (517)

State and local ........................................... (23) — (84)

Foreign ................................................. 2 (37) (19)

7 (142) (620)

$ 76 $ 189 $(434)

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to approx-

imately $807 million as of December 31, 2008 since these amounts are permanently reinvested.

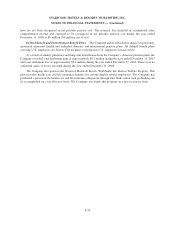

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets and

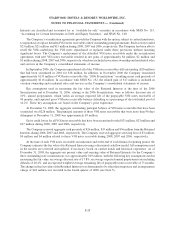

liabilities. Deferred tax assets (liabilities) include the following (in millions):

2008 2007

December 31,

Plant, property and equipment....................................... $ 389 $ 312

Intangibles ..................................................... 10 15

Allowances for doubtful accounts and other reserves ...................... 132 160

Employee benefits ............................................... 105 100

Net operating loss, capital loss and tax credit carryforwards ................. 605 723

Deferred income ................................................. (238) (102)

Other . . ....................................................... 98 108

1,101 1,316

Less valuation allowance .......................................... (488) (615)

Deferred income taxes ............................................ $ 613 $ 701

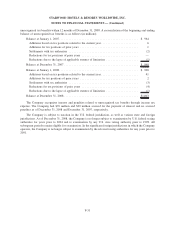

At December 31, 2008, the Company had federal and state net operating losses of approximately $29 million

and $2.4 billion, respectively, and federal tax credit carryforwards of $79 million. The Company also had foreign

net operating loss and tax credit carryforwards of approximately $32 million and $19 million, respectively. The

F-28

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)