Starwood 2008 Annual Report Download - page 58

Download and view the complete annual report

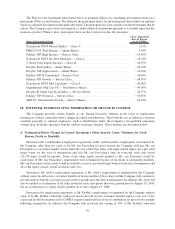

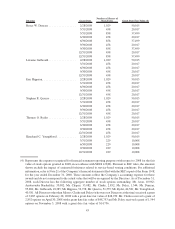

Please find page 58 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Audit-related fees include fees for audits of employee benefit plans, statutory audits required by local laws,

audit and accounting consultation and other attest services.

(3) Tax fees include fees for the preparation and review of certain foreign tax returns.

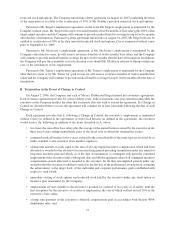

Pre-Approval of Services

The Audit Committee pre-approves all services, including both audit and non-audit services, provided by the

Company’s independent registered public accounting firm. For audit services (including statutory audit engage-

ments as required under local country laws), the independent registered public accounting firm provides the Audit

Committee with an engagement letter outlining the scope of the audit services proposed to be performed during the

year. The engagement letter must be formally accepted by the Audit Committee before any audit commences. The

independent registered public accounting firm also submits an audit services fee proposal, which also must be

approved by the Audit Committee before the audit commences. The Audit Committee may delegate authority to

one of its members to pre-approve all audit/non-audit services by the independent registered public accounting firm,

as long as these approvals are presented to the full Audit Committee at its next regularly scheduled meeting.

Management submits to the Audit Committee all non-audit services that it recommends the independent

registered public accounting firm be engaged to provide and an estimate of the fees to be paid for each. Management

and the independent registered public accounting firm must each confirm to the Audit Committee that the

performance of the non-audit services on the list would not compromise the independence of the registered public

accounting firm and would be permissible under all applicable legal requirements. The Audit Committee must

approve both the list of non-audit services and the budget for each such service before commencement of the work.

Management and the independent registered public accounting firm report to the Audit Committee at each of its

regular meetings as to the non-audit services actually provided by the independent registered public accounting firm

and the approximate fees incurred by the Company for those services.

All audit and permissible non-audit services provided by Ernst & Young to the Company for the fiscal years

ended December 31, 2008 and 2007 were pre-approved by the Audit Committee or the Board of Directors.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

All members of the Compensation Committee during fiscal year 2008 were independent Directors, and no

member was an employee or former employee. No Compensation Committee member had any relationship

requiring disclosure under “Certain Relationships and Related Transactions,” below. During fiscal year 2008, none

of our executive officers served on the compensation committee (or its equivalent) or board of Directors of another

entity whose executive officer served on our Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies of the Board of Directors of the Company

The Corporate Governance and Nominating Committee (the “Committee”) is charged with establishing and

reviewing (on a periodic basis) the Company’s Corporate Opportunity Policy pursuant to which each Director and

executive officer is required to submit to the Committee any opportunity that such person reasonably believes (1) is

within the Company’s existing line of business or (2) is one in which the Company either has an existing interest or a

reasonable expectancy of an interest, and (3) the Company is reasonably capable of pursuing. The Corporate

Opportunity Policy is a written policy that provides that the Committee should consider all relevant facts and

circumstances to determine whether it should (i) reject the proposed transaction on behalf of Company; (ii) conclude

that the proposed transaction is appropriate and suggest that the Company pursue it on the terms presented or on

different terms, and in the case of a Corporate Opportunity suggest that the Company pursue the Corporate

Opportunity on its own, with the party who brought the proposed transaction to the Company’s attention or with

another third party; or (iii) ask the full Board to consider the proposed transaction so the Board may then take either

of the actions described in (i) or (ii) above, and, at the Committee’s option, in connection with (iii), make

recommendations to the Board. Any person bringing a proposed transaction to the Committee is obligated to

46