Starwood 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• immediate vesting of all unvested 401(k) contributions in his 401(k) account or payment by the Company

of an amount equal to any such unvested amounts that are forfeited by reason of his termination of

employment.

In addition, to the extent that Mr. van Paasschen becomes subject to the “golden parachute” excise tax imposed

under Section 4999 of the Code, he would receive a gross-up payment in an amount sufficient to offset the effects of

such excise tax.

In December 2008, the Company amended the employment arrangements and change in control agreements

with each of the Named Executive Officers. The amendments were technical in nature and were designed to meet

the guidelines of 409A of the Code. The amendments did not change any of the amounts payable to the Named

Executive Officers.

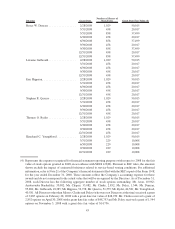

C. Estimated Payments Upon Termination

The tables below reflect the estimated amounts payable to the Named Executive Officers in the event their

employment with the Company had terminated on December 31, 2008 under various circumstances, and includes

amounts earned through that date. The actual amounts that would become payable in the event of an actual

employment termination can only be determined at the time of such termination.

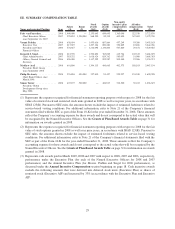

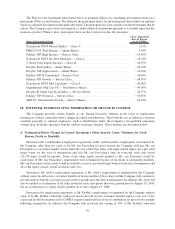

1. Involuntary Termination without Cause or Voluntary Termination for Good Reason

The following table discloses the amounts that would have become payable on account of an involuntary

termination without cause or a voluntary termination for good reason outside of the change in control context.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted Stock

($)

Vesting of

Stock Options

($)

Total

($)

van Paasschen ............. 8,000,000 0 457,4880 0 8,457,488

Prabhu .................. 640,658 23,952 867,130 0 1,531,740

Siegel(1) ................. 1,230,078 19,699 922,324 0 2,172,101

Avril(1) .................. 725,000 18,288 1,229,372 0 1,972,660

McAveety(1) .............. 500,000 18,912 0 0 518,912(2)

Turner ................... 625,000 24,888 0 0 649,888

(1) Messrs. Siegel, Avril and McAveety’s employment agreements provide for payments in the event of involuntary

termination other than for cause but do not provide for payments in the event of voluntary termination for good

reason.

(2) In addition, the Company would pay the reasonable costs of relocating Mr. McAveety to Europe if he decides to

return to Europe within one year of his termination of employment.

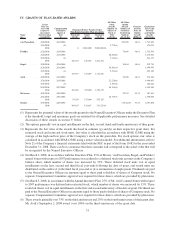

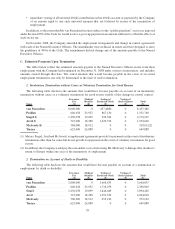

2. Termination on Account of Death or Disability

The following table discloses the amounts that would have become payable on account of a termination of

employment by death or disability.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted Stock

($)

Vesting of

Stock Options

($)

Total

($)

van Paasschen ............. 2,000,000 0 1,668,835 0 3,668,835

Prabhu .................. 640,658 23,952 1,734,259 0 2,398,869

Siegel.................... 1,230,078 19,699 1,844,649 0 3,094,426

Avril .................... 725,000 18,288 1,951,530 0 2,694,818

McAveety ................ 500,000 18,912 453,210 0 972,122

Turner ................... 625,000 24,888 0 0 649,888

39