Shaw 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity risk

Liquidity risk is the risk that the Company will experience difficulty in meeting obligations

associated with financial liabilities. The Company manages its liquidity risk by monitoring cash

flow generated from operations, available borrowing capacity, and by managing the maturity profiles

of its long term debt.

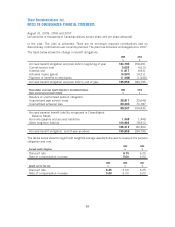

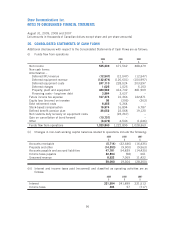

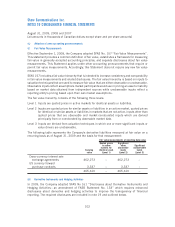

The Company’s undiscounted contractual maturities as at August 31, 2009 are as follows:

Trade and

other

payables

(1)

Long-term debt

repayable at

maturity

(2)

Other derivative

instruments

(3)

Interest

payments

(4)

Within one year 563,110 643,161 3,353 249,533

1 to 3 years – 833,877 – 352,211

3 to 5 years – 1,401,346 – 215,994

Over 5 years – 718,498 – 105,777

563,110 3,596,882 3,353 923,515

(1) Includes trade payables and accrued liabilities.

(2) US denominated long-term debt is reflected at the hedged rates for the principal repayments

(see notes 9 and 24).

(3) Includes foreign exchange forward contracts.

(4) Interest payments on long-term debt and the interest related portion of the cross-currency

interest exchange derivatives.

95

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]