Shaw 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

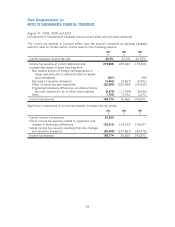

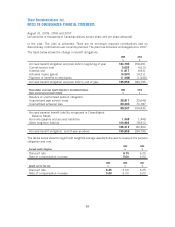

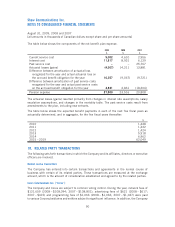

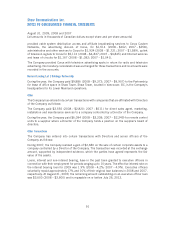

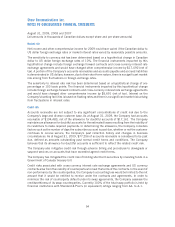

15. BUSINESS SEGMENT INFORMATION

The Company’s operating segments are Cable, DTH and Satellite Services, all of which are

substantially located in Canada.

The accounting policies of the segments are the same as those described in the summary of

significant accounting policies. Management evaluates divisional performance based on service

revenue and service operating income before charges such as amortization.

Cable

$

DTH

$

Satellite Services

$

Total

$

Total

$

Satellite

2009

Service revenue – total 2,635,832 684,831 90,205 775,036 3,410,868

Intersegment (4,850) (11,605) (3,500) (15,105) (19,955)

2,630,982 673,226 86,705 759,931 3,390,913

Service operating income before amortization 1,269,620 223,499 45,831 269,330 1,538,950

Service operating income as % of external

revenue 48.3% 33.2% 52.9% 35.4% 45.4%

Interest

(1)

209,438 n/a n/a 26,251 235,689

Burrard Landing Lot 2 Holdings Partnership 1,358

237,047

Cash taxes

(1)

23,300 – – – 23,300

Segment assets 6,602,503 855,283 498,720 1,354,003 7,956,506

Corporate assets 981,563

Total assets 8,938,069

Capital expenditures and equipment costs (net)

by segment

Capital expenditures 658,862 4,907 192 5,099 663,961

Equipment costs (net) 35,222 76,362 – 76,362 111,584

694,084 81,269 192 81,461 775,545

Reconciliation to Consolidated Statements of

Cash Flows

Additions to property, plant and equipment 677,918

Additions to equipment costs (net) 124,968

Total of capital expenditures and equipment

costs (net) per Consolidated Statements of

Cash Flows 802,886

Increase in working capital related to capital

expenditures 11,559

Less: Proceeds on disposal of property, plant

and equipment (22,081)

Less: Realized gains on cancellation of

US dollar forward purchase contracts

(2)

(13,384)

Less: Satellite services equipment profit

(4)

(3,435)

Total capital expenditures and equipment costs

(net) reported by segments 775,545

See notes following 2007 business segment table.

84

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]