Shaw 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

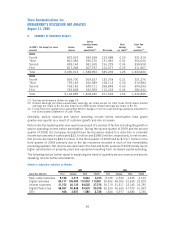

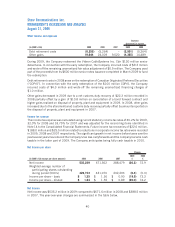

Other income and expenses

(In $000’s Cdn) 2009 2008 2007 2009 2008

Increase

(decrease) in income

Debt retirement costs (8,255) (5,264) – (2,991) (5,264)

Other gains 19,644 24,009 9,520 (4,365) 14,489

During 2009, the Company redeemed the Videon CableSystems Inc. Cdn $130 million senior

debentures. In connection with the early redemption, the Company incurred costs of $9.2 million

and wrote-off the remaining unamortized fair value adjustment of $0.9 million. The Company used

part of the proceeds from its $600 million senior notes issuance completed in March 2009 to fund

the redemption.

Debt retirement costs in 2008 arose on the redemption of Canadian Originated Preferred Securities

(“COPrS”). In connection with the early redemption of the $100 million COPrS, the Company

incurred costs of $4.3 million and wrote-off the remaining unamortized financing charges of

$1.0 million.

Other gains decreased in 2009 due to a net customs duty recovery of $22.3 million recorded in

2008 partially offset by a gain of $10.8 million on cancellation of a bond forward contract and

higher gains realized on disposal of property, plant and equipment in 2009. In 2008, other gains

increased due to the aforementioned customs duty recovery partially offset by amounts reported on

the disposal of property, plant and equipment in 2007.

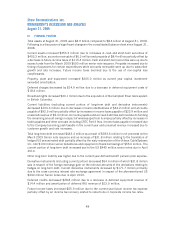

Income tax expense

The income tax expense was calculated using current statutory income tax rates of 30.2% for 2009,

32.0% for 2008 and 33.75% for 2007 and was adjusted for the reconciling items identified in

Note 14 to the Consolidated Financial Statements. Future income tax recoveries of $22.6 million,

$188.0 million and $25.5 million related to reductions in corporate income tax rates were recorded

in 2009, 2008 and 2007 respectively. The significant growth in net income before taxes over the

past several years has reduced the Company’s tax loss carryforwards and the company became cash

taxable in the latter part of 2009. The Company anticipates being fully cash taxable in 2010.

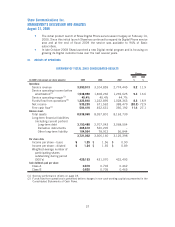

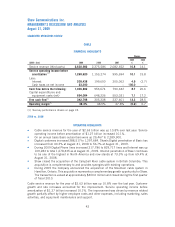

Net income per share

(In $000’s Cdn except per share amounts) 2009 2008 2007

2009

%

2008

%

Change

Net income 535,239 671,562 388,479 (20.3) 72.9

Weighted average number of

participating shares outstanding

during period (000’s) 429,153 431,070 432,493 (0.4) (0.3)

Income per share – basic $ 1.25 $ 1.56 $ 0.90 (19.9) 73.3

Income per share – diluted $ 1.24 $ 1.55 $ 0.89 (20.0) 74.2

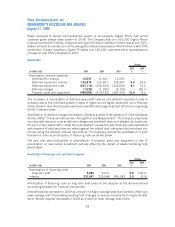

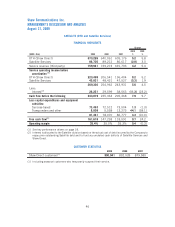

Net income

Net income was $535.2 million in 2009 compared to $671.6 million in 2008 and $388.5 million

in 2007. The year-over-year changes are summarized in the table below.

40

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009