Shaw 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

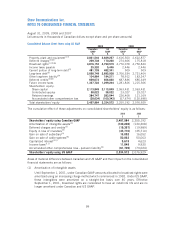

19. FINANCIAL INSTRUMENTS

Fair values

The fair value of financial instruments has been determined as follows:

(i) Current assets and current liabilities

The fair value of financial instruments included in current assets and current liabilities

approximates their carrying value due to their short-term nature.

(ii) Investments and other assets

The carrying value of investments and other assets approximates their fair value. Certain

private investments where market value is not readily determinable are carried at cost net of

write-downs.

(iii) Long-term debt

a) The carrying value of bank loans approximates their fair value because interest charges

under the terms of the bank loans are based upon current Canadian bank prime and

bankers’ acceptance rates and on US bank base and LIBOR rates.

b) The carrying value of long-term debt is at amortized cost based on the initial fair value as

determined at the time of issuance or at the time of a business acquisition. The fair value

of publicly traded notes is based upon current trading values. Other notes and

debentures are valued based upon current trading values for similar instruments.

(iv) Derivative financial instruments

The fair value of cross-currency interest rate exchange agreements and US currency contracts

is determined using an estimated credit-adjusted mark-to-market valuation.

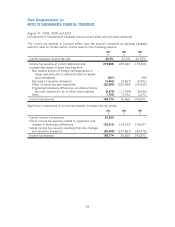

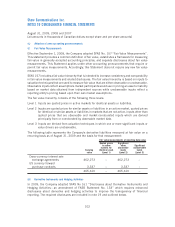

The carrying values and estimated fair values of long-term debt and all derivative financial

instrument liabilities are as follows:

Carrying

value

$

Estimated

fair value

$

Carrying

value

$

Estimated

fair value

$

2009 2008

Long-term debt 3,150,488 3,394,224 2,707,043 2,743,250

Derivative financial instruments –

Cross-currency interest rate

exchange agreements 462,273 462,273 513,385 513,385

US currency forward purchase

contracts 3,337 3,337 6,820 6,820

3,616,098 3,859,834 3,227,248 3,263,455

The maturity dates for derivative financial instruments related to long-term debt are as outlined in

note 9. US currency purchase contracts related to capital expenditures mature at various dates

during fiscal 2010.

92

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]