Shaw 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amounts were amortized on a straight-line basis over the period of the related debt instrument.

Upon adoption of these new standards on a retrospective basis without restatement, $1,754 was

credited to opening retained earnings for the cumulative net of tax difference between the two

amortization methods.

Derivative financial instruments

The Company uses derivative financial instruments to manage risks from fluctuations in foreign

exchange rates and interest rates. These instruments include cross-currency interest rate exchange

agreements, foreign currency forward purchase contracts and bond forward contracts. Effective

September 1, 2007, all derivative financial instruments are recorded at fair value in the balance

sheet. Where permissible, the Company accounts for these financial instruments as hedges which

ensures that counterbalancing gains and losses are recognized in income in the same period. With

hedge accounting, changes in the fair value of derivative financial instruments designated as cash

flow hedges are recorded in other comprehensive income (loss) until the variability of cash flows

relating to the hedged asset or liability is recognized in income (loss). When an anticipated

transaction is subsequently recorded as a non-financial asset, the amounts recognized in other

comprehensive income (loss) are reclassified to the initial carrying amount of the related asset.

Where hedge accounting is not permissible, the changes in fair value are immediately recognized in

income (loss).

Instruments that have been entered into by the Company to hedge exposure to foreign exchange and

interest rate risk are reviewed on a regular basis to ensure the hedges are still effective and that

hedge accounting continues to be appropriate.

Prior to September 1, 2007, the carrying value of derivative financial instruments designated as

hedges were only adjusted to fair value when hedge accounting was not permissible. The resulting

gains and losses were immediately recognized in income (loss). The adoption of the new financial

instruments standards resulted in a charge of $57,227, net of tax, to accumulated other

comprehensive loss.

Employee benefit plans

The Company accrues its obligations and related costs under its employee benefit plans. The cost of

pensions and other retirement benefits earned by certain senior employees is actuarially

determined using the projected benefit method pro-rated on service and management’s best

estimate of salary escalation and retirement ages of employees. Past service costs from plan

initiation and amendments are amortized on a straight-line basis over the estimated average

remaining service life (“EARSL”) of employees active at the date of recognition of past service

unless identification of a circumstance would suggest a shorter amortization period is appropriate.

Negative plan amendments which reduce costs are applied to reduce any existing unamortized past

service costs. The excess, if any, is amortized on a straight-line basis over EARSL. Actuarial gains or

losses occur because assumptions about benefit plans relate to a long time frame and differ from

actual experiences. These assumptions are revised based on actual experience of the plan such as

changes in discount rates, expected retirement ages and projected salary increases. Actuarial gains

(losses) are amortized on a straight-line basis over EARSL which for active employees covered by

the defined benefit pension plan is 11.1 years at August 31, 2009 (2008 – 12.1 years; 2007 –

66

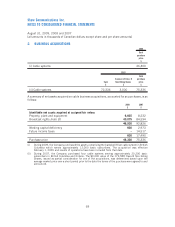

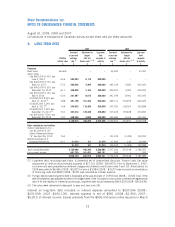

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]