Shaw 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

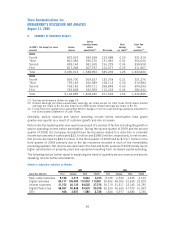

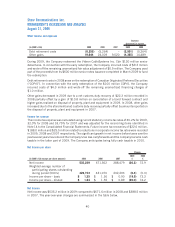

II. SUMMARY OF QUARTERLY RESULTS

(In $000’s Cdn except per share

amounts)

Service

revenue

Service

operating income

before

amortization

(1)

Net income

Basic

earnings

per share

(2)

Funds flow

from

operations

(3)

2009

Fourth 872,919 394,528 123,988 0.29 321,319

Third 861,382 395,270 131,945 0.31 356,046

Second 839,144 381,355 156,229 0.36 334,508

First 817,468 367,797 123,077 0.29 311,967

Total 3,390,913 1,538,950 535,239 1.25 1,323,840

2008

Fourth 805,700 369,527 132,378 0.31 321,276

Third 792,149 356,089 128,113 0.30 310,984

Second 763,182 349,711 298,848 0.69 304,293

First 743,828 332,909 112,223 0.26 286,342

Total 3,104,859 1,408,236 671,562 1.56 1,222,895

(1) See key performance drivers on page 18.

(2) Diluted earnings per share equals basic earnings per share except for total fiscal 2009 where diluted

earnings per share is $1.24 and total fiscal 2008 where diluted earnings per share is $1.55.

(3) Funds flow from operations is presented before changes in net non-cash working capital as presented in

the Consolidated Statement of Cash Flows.

Generally, service revenue and service operating income before amortization have grown

quarter-over-quarter as a result of customer growth and rate increases.

Net income fluctuated quarter-over-quarter as a result of a number of factors including the growth in

service operating income before amortization. During the second quarter of 2009 and the second

quarter of 2008, the Company recorded future tax recoveries related to a reduction in corporate

income tax rates which contributed $22.6 million and $188.0 million, respectively, to net income.

Net income declined by $24.3 million in the third quarter of 2009 and by $170.7 million in the

third quarter of 2008 primarily due to the tax recoveries recorded in each of the immediately

preceding quarters. Net income also declined in the first and fourth quarters of 2009 mainly due to

higher amortization of property, plant and equipment resulting from increased capital spending.

The following factors further assist in explaining the trend of quarterly service revenue and service

operating income before amortization:

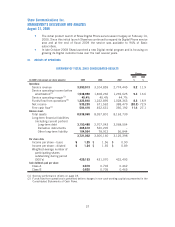

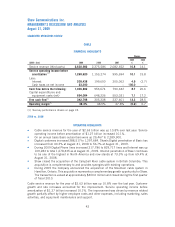

Growth in subscriber statistics as follows:

Subscriber Statistics First Second Third Fourth First Second Third Fourth

2009 2008

Basic cable customers 9,198 4,273 9,622 6,374 8,138 6,524 2,495 4,122

Digital customers 60,717 106,489 110,810 110,501 39,496 48,006 32,658 23,020

Internet customers 31,152 26,130 24,625 27,376 34,719 31,517 23,185 24,785

Digital Phone lines 56,597 50,848 54,633 55,708 50,339 56,536 57,700 61,999

DTH 448 3,657 1,580 2,728 1,544 4,977 4,686 1,736

36

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009