Shaw 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw continued to deliver solid subscriber growth in all products. Digital Phone had record

customer gains almost every quarter in 2008. The Company had over 610,000 Digital Phone

lines and penetration of Basic customers who have the service available to them was at over 30%.

Shaw continued to maintain one of the strongest broadband businesses in North America with 70%

penetration of basic customers. Digital TV added over 140,000 customers which represented an

increase of over 55% compared to 2007.

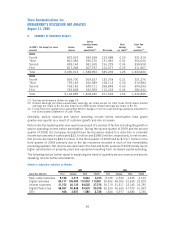

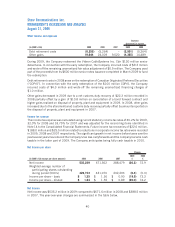

Amortization

(In $000’s Cdn) 2009 2008 2007

2009

%

2008

%

Change

Amortization revenue (expense) –

Deferred IRU revenue 12,547 12,547 12,547 ––

Deferred equipment revenue 132,974 126,601 104,997 5.0 20.6

Deferred equipment costs (247,110) (228,524) (203,597) 8.1 12.2

Deferred charges (1,025) (1,025) (5,153) –(80.1)

Property, plant and equipment (480,582) (414,732) (381,909) 15.9 8.6

The increases in amortization of deferred equipment revenue and deferred equipment costs is

primarily due to the continued growth in sales of higher priced digital equipment up to February

2009, at which time the Company launched a new HD rental program as part of its focus on growing

the HD customer base.

Amortization of deferred charges decreased in 2008 as a result of the adoption of CICA Handbook

Section 3855, “Financial Instruments – Recognition and Measurement”. The Company previously

recorded debt issuance costs as deferred charges and amortized them on a straight-line basis over

the term of the related debt. Under the new standard, transaction and financing costs associated

with issuance of debt securities are netted against the related debt instrument and amortized into

income using the effective interest rate method. The Company records the amortization of such

transaction costs as amortization of financing costs as shown below.

The year over year fluctuations in amortization of property, plant and equipment is due to

amortization on new capital investment partially offset by the impact of assets becoming fully

depreciated.

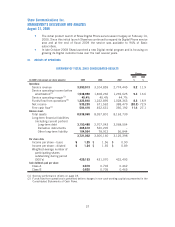

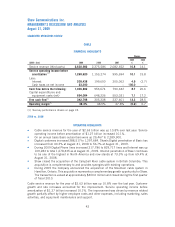

Amortization of financing costs and Interest expense

(In $000’s Cdn) 2009 2008 2007

2009

%

2008

%

Change

Amortization of financing costs –

long-term debt 3,984 3,627 – 9.8 100.0

Interest 237,047 230,588 245,043 2.8 (5.9)

Amortization of financing costs on long-term debt arose on the adoption of the aforementioned

accounting standard for financial instruments.

Interest expense increased in 2009 as a result of a higher average debt level partially offset by a

lower average cost of borrowing resulting from changes in various components of long-term debt

while interest expense decreased in 2008 as a result of lower average debt levels.

39

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009