Shaw 2009 Annual Report Download - page 105

Download and view the complete annual report

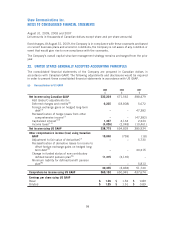

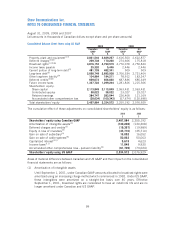

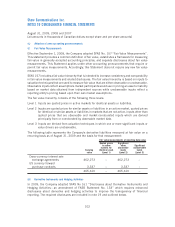

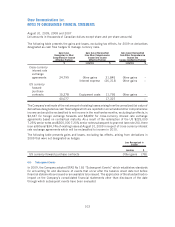

Please find page 105 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(7) Derivative instruments and hedging activities

Under US GAAP, all derivatives are recognized in the Consolidated Balance Sheet at fair

value. Derivatives that are not hedges are adjusted to fair value through income. Derivatives

that are hedges are adjusted through income or other comprehensive income until the hedged

item is recognized in income depending on the nature of the hedge.

Until September 1, 2007 under Canadian GAAP, only speculative derivative financial

instruments and those that did not qualify for hedge accounting were recognized in the

Consolidated Balance Sheet.

(8) Subscriber connection fee revenue and related costs

Subscriber connection fee revenue and related costs are deferred and amortized under

Canadian GAAP. Under US GAAP, connection revenues are recognized immediately to the

extent of related costs, with any excess deferred and amortized.

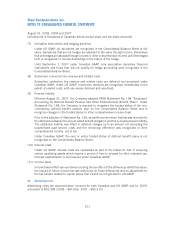

(9) Pension liability

Effective August 31, 2007, the Company adopted FASB Statement No. 158 “Employers’

Accounting for Defined Benefit Pension and Other Postretirement Benefit Plans”. Under

Statement No. 158, the Company is required to recognize the funded status of the non-

contributory defined benefit pension plan on the Consolidated Balance Sheet and to

recognize changes in the funded status in other comprehensive income (loss).

Prior to the adoption of Statement No. 158, an additional minimum liability was recorded for

the difference between the accumulated benefit obligation and the accrued pension liability.

The additional liability was offset in deferred charges up to an amount not exceeding the

unamortized past service costs and the remaining difference was recognized in other

comprehensive income, net of tax.

Under Canadian GAAP, the over or under funded status of defined benefit plans is not

recognized on the Consolidated Balance Sheet.

(10) Interest costs

Under US GAAP, interest costs are capitalized as part of the historical cost of acquiring

certain qualifying assets which require a period of time to prepare for their intended use.

Interest capitalization is not required under Canadian GAAP.

(11) Income taxes

Income taxes reflect various items including the tax effect of the differences identified above,

the impact of future income tax rate reductions on those differences and an adjustment for

the tax benefit related to capital losses that cannot be recognized for US GAAP.

(b) Advertising costs

Advertising costs are expensed when incurred for both Canadian and US GAAP and for 2009,

amounted to $52,384 (2008 – $47,656; 2007 – $43,210).

101

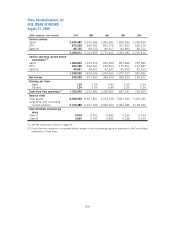

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]