Shaw 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

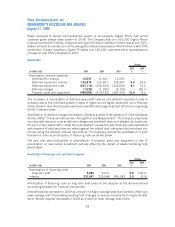

kThe initial product launch of Shaw Digital Phone service was in Calgary on February 14,

2005. Since this initial launch Shaw has continued to expand its Digital Phone service

area and at the end of fiscal 2009 the service was available to 94% of Basic

subscribers.

kIn late October 2008 Shaw launched a new Digital rental program and is focusing on

growing its Digital customer base over the next several years.

III. RESULTS OF OPERATIONS

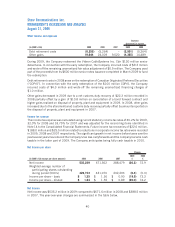

OVERVIEW OF FISCAL 2009 CONSOLIDATED RESULTS

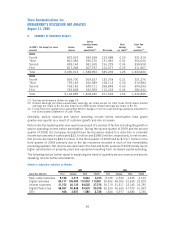

(In $000’s Cdn except per share amounts) 2009 2008 2007

2009

%

2008

%

Change

Operations:

Service revenue 3,390,913 3,104,859 2,774,445 9.2 11.9

Service operating income before

amortization

(1)

1,538,950 1,408,236 1,239,625 9.3 13.6

Service operating margin

(1)

45.4% 45.4% 44.7%

Funds flow from operations

(2)

1,323,840 1,222,895 1,028,363 8.3 18.9

Net income 535,239 671,562 388,479 (20.3) 72.9

Free cash flow

(1)

504,416 452,631 356,192 11.4 27.1

Balance sheet:

Total assets 8,938,069 8,357,801 8,163,739

Long-term financial liabilities

(including current portion)

Long-term debt 3,150,488 2,707,043 3,068,554

Derivative instruments 465,610 520,205 –

Other long-term liability 104,964 78,912 56,844

3,721,062 3,306,160 3,125,398

Per share data:

Income per share – basic $ 1.25 $ 1.56 $ 0.90

Income per share – diluted $ 1.24 $ 1.55 $ 0.89

Weighted average number of

participating shares

outstanding during period

(000’s) 429,153 431,070 432,493

Cash dividends paid per share

Class A 0.818 0.702 0.462

Class B 0.820 0.705 0.465

(1) See key performance drivers on page 18.

(2) Funds flow from operations is presented before changes in non-cash working capital as presented in the

Consolidated Statements of Cash Flows.

37

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009