Shaw 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(c) Adoption of new accounting pronouncements

(i) Fair Value Measurements

Effective September 1, 2008, the Company adopted SFAS No. 157 “Fair Value Measurements”.

This statement provides a common definition of fair value, establishes a framework for measuring

fair value in generally accepted accounting principles, and expands disclosures about fair value

measurements. This Statement applies under other accounting pronouncements that require or

permit fair value measurements. Accordingly, this Statement does not require any new fair value

measurements.

SFAS 157 includes a fair value hierarchy that is intended to increase consistency and comparability

in fair value measurements and related disclosures. The fair value hierarchy is based on inputs to

valuation techniques that are used to measure fair value that are either observable or unobservable.

Observable inputs reflect assumptions market participants would use in pricing an asset or liability

based on market data obtained from independent sources while unobservable inputs reflect a

reporting entity’s pricing based upon their own market assumptions.

The fair value hierarchy consists of the following three levels:

Level 1 Inputs are quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs are quoted prices for similar assets or liabilities in an active market, quoted prices

for identical or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable and market-corroborated inputs which are derived

principally from or corroborated by observable market data.

Level 3 Inputs are derived from valuation techniques in which one or more significant inputs or

value drivers are unobservable.

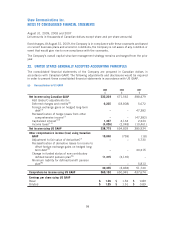

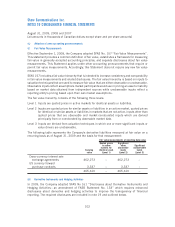

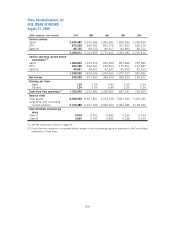

The following table represents the Company’s derivative liabilities measured at fair value on a

recurring basis as of August 31, 2009 and the basis for that measurement:

Carrying

value

Quoted prices

in active

markets for

identical asset

(Level 1)

Significant

other

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

Fair value measurements at reporting date using

Cross-currency interest rate

exchange agreements 462,273 – 462,273 –

US currency forward

purchase contracts 3,337 – 3,337 –

465,610 – 465,610 –

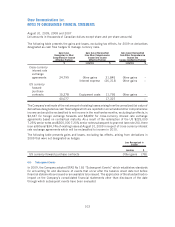

(ii) Derivative Instruments and Hedging Activities

In 2009, the Company adopted SFAS No 161 “Disclosures about Derivative Instruments and

Hedging Activities – an amendment of FASB Statement No. 133” which requires enhanced

disclosures about derivative and hedging activities to improve the transparency of financial

reporting. The required disclosures are included in note 19 and outlined below.

102

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]