Shaw 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share capital increased by $50.4 million primarily due to the issuance of 3,488,130 Class B Non-

Voting Shares under the Company’s option plans for $59.0 million partially offset by the repurchase

of 1,683,000 Class B Non-Voting Shares for $33.6 million of which $8.6 million reduced stated

share capital and $25.0 million was charged against retained earnings. As of November 24, 2009,

share capital is as reported at August 31, 2009 with the exception of the issuance of 441,618

Class B Non-Voting Shares upon exercise of options subsequent to the year end and issuance of

6,141,250 Class B Non-Voting Shares in respect of the acquisition of Mountain Cable in Hamilton.

Contributed surplus increased due to stock-based compensation expense recorded in the current

year. Accumulated other comprehensive loss decreased primarily due to a decline in the unrealized

losses on derivative instruments related to US denominated long-term debt.

V. CONSOLIDATED CASH FLOW ANALYSIS

Operating activities

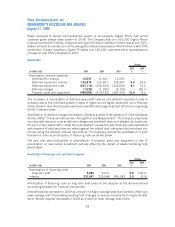

(In $000’s Cdn) 2009 2008 2007

2009

%

2008

%

Change

Funds flow from operations 1,323,840 1,222,895 1,028,363 8.3 18.9

Net decrease (increase) in non-

cash working capital balances

related to operations 59,090 19,304 (28,350) 206.1 168.1

1,382,930 1,242,199 1,000,013 11.3 24.2

Funds flow from operations increased year-over-year due to growth in service operating income

before amortization which was partially offset by current income tax expense in 2009. The

year-over-year net change in non-cash working capital balances is primarily due to timing of

collection of accounts receivable and payment of accounts payable and accrued liabilities in

addition to the provision for current taxes payable in 2009 as the Company became cash taxable.

Investing activities

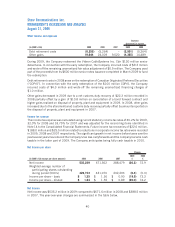

(In $000’s Cdn) 2009 2008 2007 2009 2008

Increase

Cash flow used in investing

activities (966,716) (734,135) (719,777) (232,581) (14,358)

In 2009, the primary uses of cash for investing activities were capital expenditures and equipment

costs (net) of $802.9 million, final deposits for wireless spectrum licenses of $152.5 million and

the acquisition of the Campbell River cable system of $46.3 million, all of which were partially

offset by proceeds on disposal of property, plant and equipment of $22.1 million and proceeds on

cancellation of certain US dollar forward purchase contracts of $13.4 million.

In 2008, the primary uses of cash for investing activities were capital expenditures and equipment

costs (net) of $727.4 million and deposits for wireless spectrum licenses of $38.4 million, both of

which were partially offset by a net customs duty recovery of $22.3 million.

49

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009