Shaw 2009 Annual Report Download - page 95

Download and view the complete annual report

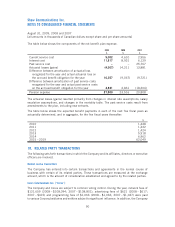

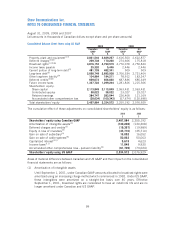

Please find page 95 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.provided cable system distribution access and affiliate broadcasting services to Corus Custom

Networks, the advertising division of Corus, for $1,514 (2008 – $262; 2007 – $258),

administrative and other services to Corus for $1,934 (2008 – $1,721; 2007 – $1,589), uplink

of television signals to Corus for $5,112 (2008 – $4,837; 2007 – $4,845) and Internet services

and lease of circuits for $1,167 (2008 – $1,082; 2007 – $1,041).

The Company provided Corus with television advertising spots in return for radio and television

advertising. No monetary consideration was exchanged for these transactions and no amounts were

recorded in the accounts.

Burrard Landing Lot 2 Holdings Partnership

During the year, the Company paid $9,886 (2008 – $9,372; 2007 – $9,907) to the Partnership

for lease of office space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is the Company’s

headquarters for its Lower Mainland operations.

Other

The Company has entered into certain transactions with companies that are affiliated with Directors

of the Company as follows:

The Company paid $3,555 (2008 – $2,820; 2007 – $511) for direct sales agent, marketing,

installation and maintenance services to a company controlled by a Director of the Company.

During the year, the Company paid $6,094 (2008 – $3,208; 2007 – $2,249) for remote control

units to a supplier where a Director of the Company holds a position on the supplier’s board of

directors.

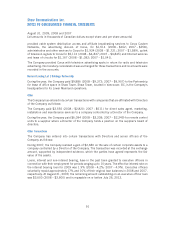

Other transactions

The Company has entered into certain transactions with Directors and senior officers of the

Company as follows:

During 2007, the Company realized a gain of $2,680 on the sale of certain corporate assets to a

company controlled by a Director of the Company. The transaction was recorded at the exchange

amount, supported by independent evidence, which the parties have agreed represents the fair

value of the assets.

Loans, interest and non-interest bearing, have in the past been granted to executive officers in

connection with their employment for periods ranging up to 10 years. The effective interest rate on

the interest bearing loan for 2009 was 1.9% (2008 – 4.2%; 2007 – 4.9%). Executive officers

voluntarily repaid approximately 17% and 10% of their original loan balances in 2008 and 2007,

respectively. At August 31, 2009, the remaining amount outstanding on an executive officer loan

was $3,600 (2008 – $3,600) and is repayable on or before July 26, 2012.

91

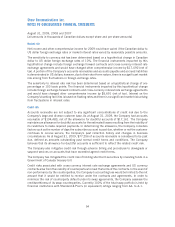

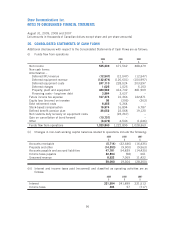

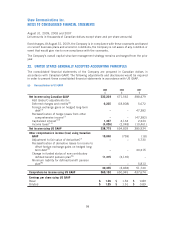

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]