Shaw 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Indemnities

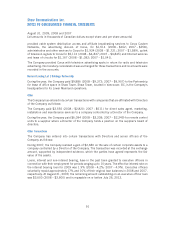

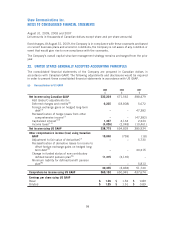

Many agreements related to acquisitions and dispositions of business assets include

indemnification provisions where the Company may be required to make payment to a vendor or

purchaser for breach of contractual terms of the agreement with respect to matters such as

litigation, income taxes payable or refundable or other ongoing disputes. The indemnification

period usually covers a period of two to four years. Also, in the normal course of business, the

Company has provided indemnifications in various commercial agreements, customary for the

telecommunications industry, which may require payment by the Company for breach of contractual

terms of the agreement. Counterparties to these agreements provide the Company with comparable

indemnifications. The indemnification period generally covers, at maximum, the period of the

applicable agreement plus the applicable limitations period under law.

The maximum potential amount of future payments that the Company would be required to make

under these indemnification agreements is not reasonably quantifiable as certain indemnifications

are not subject to limitation. However, the Company enters into indemnification agreements only

when an assessment of the business circumstances would indicate that the risk of loss is remote. At

August 31, 2009, management believes it is remote that the indemnification provisions would

require any material cash payment.

The Company indemnifies its directors and officers against any and all claims or losses reasonably

incurred in the performance of their service to the Company to the extent permitted by law.

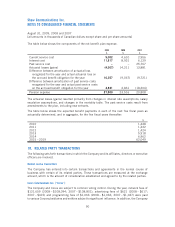

Irrevocable standby letters of credit and performance bonds

The Company and certain of its subsidiaries have granted irrevocable standby letters of credit and

performance bonds, issued by high rated financial institutions, to third parties to indemnify them in

the event the Company does not perform its contractual obligations. As of August 31, 2009, the

guarantee instruments amounted to $1,032 (2008 – $158,296). The Company has not recorded

any additional liability with respect to these guarantees, as the Company does not expect to make

any payments in excess of what is recorded on the Company’s consolidated financial statements.

The guarantee instruments mature at various dates during fiscal 2010 to 2012.

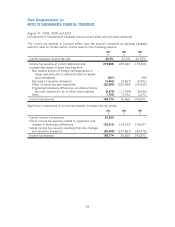

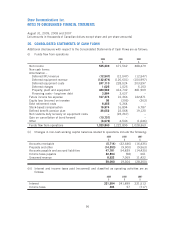

17. PENSION PLANS

Defined contribution pension plans

The Company has defined contribution pension plans for all non-union employees and contributes

5% of eligible earnings to the maximum amount deductible under the Income Tax Act. For union

employees, the Company contributes amounts up to 7.5% of earnings to the individuals’ registered

retirement savings plans. Total pension costs in respect of these plans for the year were $21,148

(2008 – $17,622; 2007 – $14,486) of which $12,281 (2008 – $10,214; 2007 – $8,586) was

expensed and the remainder capitalized.

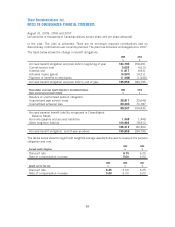

Defined benefit pension plan

The Company provides a non-contributory defined benefit pension plan for certain of its senior

executives. Benefits under this plan are based on the employees’ length of service and their highest

three-year average rate of pay during their years of service. Employees are not required to contribute

88

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]