Shaw 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

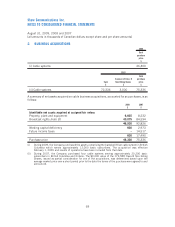

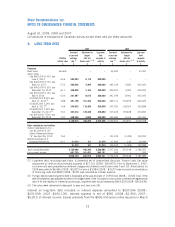

Property, plant and equipment

Property, plant and equipment are recorded at purchase cost. Direct labour and direct overhead

incurred to construct new assets, upgrade existing assets and connect new subscribers are

capitalized. Repairs and maintenance expenditures are charged to operating expense as incurred.

Amortization is recorded on a straight-line basis over the estimated useful lives of assets as follows:

Asset Estimated useful life

Cable and telecommunications distribution system 6-15 years

Digital cable terminals and modems 2-7 years

Satellite audio, video and data network equipment and DTH receiving

equipment 4-10 years

Buildings 20-40 years

Data processing 4 years

Other 3-20 years

The Company reviews property, plant and equipment for impairment whenever events or changes in

circumstances indicate that the carrying value may not be recoverable. An impairment is recognized

when the carrying amount of an asset is greater than the future undiscounted net cash flows

expected to be generated by the asset. The impairment is measured as the difference between the

carrying value of the asset and its fair value calculated using quoted market prices or discounted

cash flows.

Deferred charges

Deferred charges primarily include (i) equipment costs, as described in the revenue and expenses

accounting policy, deferred and amortized on a straight-line basis over two to five years; (ii) credit

facility arrangement fees amortized on a straight-line basis over the term of the facility; (iii) costs

incurred in respect of connection fee revenue and upfront installation revenue, as described in the

revenue and expenses accounting policy, deferred and amortized over two to ten years; and (iv) the

non-current portion of prepaid maintenance and support contracts.

Intangibles

The excess of the cost of acquiring cable and satellite businesses over the fair value of related net

identifiable tangible and intangible assets acquired is allocated to goodwill. Net identifiable

intangible assets acquired consist of amounts allocated to broadcast rights which represent

identifiable assets with indefinite useful lives.

Goodwill and intangible assets with an indefinite life are not amortized but are subject to an annual

review for impairment. Identifiable intangibles are tested for impairment by comparing the

estimated fair value of the intangible asset with its carrying amount. Goodwill impairment is

determined using a two-step process. The first step involves a comparison of the estimated fair

value of the reporting unit to its carrying amount, including goodwill. If the fair value of a reporting

unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired, thus the

second step of the impairment test is unnecessary. If the carrying amount of the reporting unit

exceeds its fair value, the second step of the impairment test is performed to measure the amount of

the impairment loss.

64

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]