Shaw 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

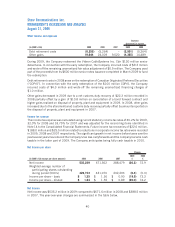

Financing activities

The changes in financing activities during the year were as follows:

(In millions Cdn) 2009 2008 2007

Redemption of COPrS –(100.0) –

Repayment of Videon CableSystems Inc. 8.15% senior

debentures (130.0) ––

Net proceeds on issuance of Cdn $600 million 6.50% senior

notes 593.6 ––

Cost to terminate foreign currency forward contracts –– (0.4)

Repayment of $296.8 million senior notes –(296.8) –

Bank loans and bank indebtedness – net borrowings

(repayments) (99.2) 99.2 (300.4)

Purchase of Class B Non-Voting Shares for cancellation (33.6) (99.8) (104.8)

Dividends (351.9) (303.8) (201.2)

Debt retirement costs (9.2) (4.3) –

Proceeds on bond forward contracts 10.8 – 0.2

Issuance of Class B Non-Voting Shares 57.0 32.5 92.1

Repayment of Partnership debt (0.5) (0.4) (0.4)

Proceeds on $400 million senior unsecured notes –– 400.0

Cash flow used in financing activities 37.0 (673.4) (114.9)

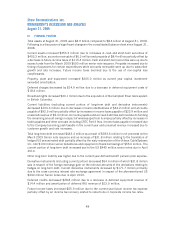

VI. LIQUIDITY AND CAPITAL RESOURCES

In the current year, the Company generated $504.4 million of consolidated free cash flow. Shaw

used its free cash flow along with net proceeds of $593.6 million from its senior notes offering,

proceeds on cancellation of US dollar forward purchase contracts and a bond forward contract of

$24.1 million, proceeds on issuance of Class B Non-Voting Shares of $57.0 million, working

capital reduction of $70.6 million and other net items of $17 million to redeem the Videon

CableSystems Inc. Cdn$130 million senior debentures, purchase $33.6 million of Class B Non-

Voting Shares for cancellation, repay debt and bank indebtedness of $99.2 million, pay common

share dividends of $351.9 million, fund the final cash payment of $152.5 million related to

deposits on wireless spectrum licenses and purchase the Campbell River cable system for

$46.3 million. The remaining $453.2 million was held in cash and short-term securities.

To allow for timely access to capital markets, Shaw filed a short form base shelf prospectus with

securities regulators in Canada and the U.S. on March 11, 2009. The shelf prospectus allows for

the issue of up to an aggregate $2.5 billion of debt and equity securities over a 25 month period.

Pursuant to this shelf prospectus, the Company completed three senior note offerings totaling

$2.5 billion as follows:

kOn March 27, 2009, Shaw issued $600 million of senior notes at a rate of 6.50% due June 2,

2014. Net proceeds (after issue and underwriting expenses) of $593.6 million were used for

debt repayment, working capital and general corporate purposes. Excess funds are being held

in cash and short-term securities.

kOn October 1, 2009, the Company issued $1.25 billion of senior notes at a rate of 5.65% due

2019. Estimated net proceeds (after issuance at a discount of $4.0 million and, issue and

underwriting expenses) of $1.24 billion were used for debt repayment. Subsequent to year

end, the Company redeemed all of its outstanding US $440 million 8.25% senior notes due

50

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009