Shaw 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investments and other assets

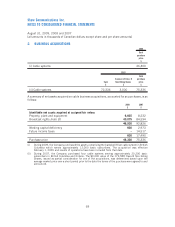

Investments in other entities are accounted for using the equity method or cost basis depending

upon the level of ownership and/or the Company’s ability to exercise significant influence over the

operating and financial policies of the investee. Investments of this nature are recorded at original

cost and adjusted periodically to recognize the Company’s proportionate share of the investee’s net

income or losses after the date of investment, additional contributions made and dividends

received. Investments are written down when there is clear evidence that a decline in value that

is other than temporary has occurred.

Amounts paid and payable for spectrum licenses are recorded as deposits until Industry Canada

awards the operating licenses which was subject to approval of documents at year end.

Revenue and expenses

(i) Service revenue

Service revenue from cable, Internet, Digital Phone and DTH customers includes subscriber service

revenue earned as services are provided. Satellite distribution services and telecommunications

service revenue is recognized in the period in which the services are rendered to customers.

Subscriber connection fees received from customers are deferred and recognized as service revenue

on a straight-line basis over two years. Direct and incremental initial selling, administrative and

connection costs related to subscriber acquisitions, in an amount not exceeding initial subscriber

connection fee revenue, are deferred and recognized as an operating expense on a straight-line

basis over the same two years. The costs of physically connecting a new home are capitalized as part

of the distribution system and costs of disconnections are expensed as incurred.

Installation revenue received on contracts with commercial business customers is deferred and

recognized as service revenue on a straight-line basis over the related service contract, which

generally span two to ten years. Direct and incremental costs associated with the service contract, in

an amount not exceeding the upfront installation revenue, are deferred and recognized as an

operating expense on a straight-line basis over the same period.

(ii) Deferred equipment revenue and deferred equipment costs

Revenue from sales of modems, DTH equipment and digital cable terminals (“DCTs”) is deferred

and recognized on a straight-line basis over two years commencing when subscriber service is

activated. The total cost of the equipment, including installation, is deferred and recognized on a

straight-line basis over the same period. The DCT, DTH and modem equipment is generally sold to

customers at cost or a subsidized price in order to expand the Company’s customer base.

Revenue from sales of satellite tracking hardware and costs of goods sold are deferred and

recognized on a straight-line basis over the related service contract for monthly service charges

for air time, which is generally five years. The amortization of the revenue and cost of sale of satellite

service equipment commences when goods are shipped.

Recognition of deferred equipment revenue and deferred equipment costs is recorded as deferred

equipment revenue amortization and deferred equipment costs amortization, respectively.

62

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]