Shaw 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Industry Canada and/or the CRTC. The Corporation’s operations and results can be affected,

possibly adversely, by changes in regulations and decisions in connection with regulations and

policies, including changes in interpretations or the language of existing regulations by courts, the

regulator (the CRTC) or the government. This regulation relates to, among other things, licensing,

competition, programming carriage and the potential for new or increased fees.

The Corporation’s CRTC licenses for its BDUs must be renewed from time to time and cannot be

transferred without regulatory approval. The Corporation holds a separate license, or operates

pursuant to an exemption order, for each of its cable, DTH and SRDU undertakings, upon which the

provision of each service is dependent. CRTC licenses have generally been issued for terms of up to

seven years. The majority of the Corporation’s licensed cable undertakings were renewed by the

CRTC in August, 2008 for a two-year period expiring August 31, 2010. The licenses of its DTH and

SRDU undertakings also currently expire August 31, 2010. Shaw has recently filed renewal

applications for full-term, seven-year license renewals. Shaw has never failed to obtain a license

renewal for any of its cable, DTH or SRDU undertakings.

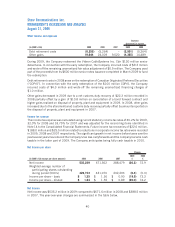

ii) Interest rate, foreign exchange, market value, capital market and economic conditions risks

Shaw manages its exposure to floating interest rates and US dollar foreign exchange fluctuation

through the use of interest rate and cross-currency exchange agreements or “swaps”. In order to

minimize the risk of counterparty default under its swap agreements, Shaw assesses the

creditworthiness of its swap counterparties. Currently 100% of the total swap portfolio is held

by financial institutions with Standard & Poor’s (or equivalent) ratings ranging from AA- to A-1.

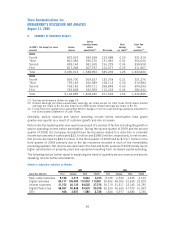

As at August 31, 2009 Shaw has the following financial exposures at risk in its day-to-day

operations:

(a) Interest rates: Due to the capital-intensive nature of Shaw’s operations, the Company

utilizes long-term financing extensively in its capital structure. The primary

components of this structure are:

1. Banking facilities as more fully described in Note 9 to the Consolidated

Financial Statements.

2. Various Canadian and US denominated senior notes and debentures with varying

maturities issued in the public and private markets as more fully described in

Note 9 to the Consolidated Financial Statements.

Interest on bank indebtedness is based on floating rates, while the senior notes and

debentures are fixed-rate obligations. If required, Shaw utilizes its credit facility to

finance day-to-day operations and, depending on market conditions, periodically

converts the bank loans to fixed-rate instruments through public market debt issues.

As at August 31, 2009, 100% of Shaw’s consolidated long-term debt was fixed with

respect to interest rates.

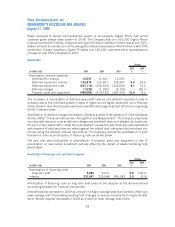

(b) Foreign exchange: As the Company has grown it has accessed US capital markets for a

portion of its borrowings. As at August 31, 2009 the Company had the following three

series of senior notes outstanding that were denominated in US dollars:

kUS $440 million 8.25% senior notes due April 11, 2010,

kUS $225 million 7.25% senior notes due April 6, 2011, and

kUS $300 million 7.20% senior notes due December 15, 2011.

32

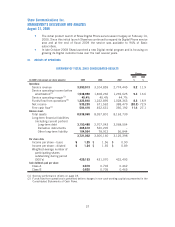

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009