Shaw 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

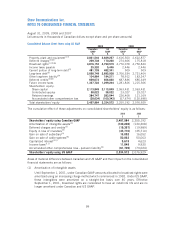

to the plan. The plan is unfunded. There are no minimum required contributions and no

discretionary contributions are currently planned. The plan has remained unchanged since 2007.

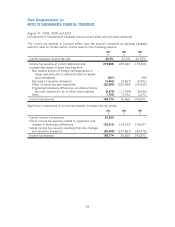

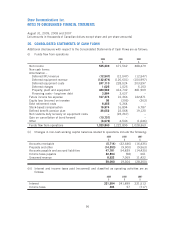

The table below shows the change in benefit obligations.

2009

$

2008

$

Accrued benefit obligation and plan deficit, beginning of year 184,795 158,491

Current service cost 5,002 4,610

Interest cost 11,817 8,931

Actuarial losses (gains) (4,507) 14,211

Payment of benefits to employees (1,448) (1,448)

Accrued benefit obligation and plan deficit, end of year 195,659 184,795

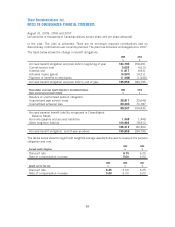

Reconciliation of accrued benefit obligation to Consolidated Balance

Sheet accrued pension benefit liability

2009

$

2008

$

Balance of unamortized pension obligation:

Unamortized past service costs 28,817 33,648

Unamortized actuarial loss 60,430 70,787

89,247 104,435

Accrued pension benefit liability recognized in Consolidated

Balance Sheet:

Accounts payable and accrued liabilities 1,448 1,448

Other long-term liability 104,964 78,912

106,412 80,360

Accrued benefit obligation, end of year as above 195,659 184,795

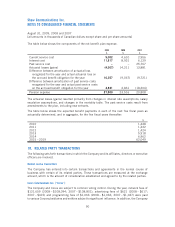

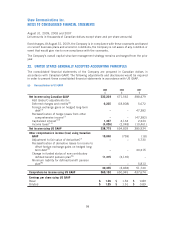

The tables below show the significant weighted-average assumptions used to measure the pension

obligation and cost.

Accrued benefit obligation

2009

%

2008

%

Discount rate 6.75 6.25

Rate of compensation increase 5.00 5.00

Benefit cost for the year

2009

%

2008

%

2007

%

Discount rate 6.25 5.50 5.25

Rate of compensation increase 5.00 5.00 5.00

89

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]