Shaw 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

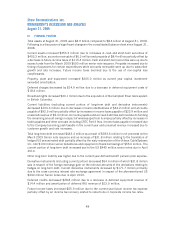

Shaw Communications Inc.

CONSOLIDATED STATEMENTS OF INCOME AND RETAINED EARNINGS (DEFICIT)

Years ended August 31 [thousands of Canadian dollars

except per share amounts]

2009

$

2008

$

2007

$

Service revenue [note 15] 3,390,913 3,104,859 2,774,445

Operating, general and administrative expenses 1,851,963 1,696,623 1,534,820

Service operating income before amortization

[note 15] 1,538,950 1,408,236 1,239,625

Amortization –

Deferred IRU revenue [note 10] 12,547 12,547 12,547

Deferred equipment revenue [note 10] 132,974 126,601 104,997

Deferred equipment costs [note 7] (247,110) (228,524) (203,597)

Deferred charges [note 7] (1,025) (1,025) (5,153)

Property, plant and equipment [note 6] (480,582) (414,732) (381,909)

Operating income 955,754 903,103 766,510

Amortization of financing costs – long-term

debt [note 9] (3,984) (3,627) –

Interest [notes 7, 9, 10 and 13] (237,047) (230,588) (245,043)

714,723 668,888 521,467

Debt retirement costs [note 9] (8,255) (5,264) –

Other gains [note 1] 19,644 24,009 9,520

Income before income taxes 726,112 687,633 530,987

Income tax expense [note 14] 190,774 16,366 142,871

Income before the following 535,338 671,267 388,116

Equity income (loss) on investee (99) 295 363

Net income 535,239 671,562 388,479

Retained earnings (deficit), beginning of year 226,408 (68,132) (172,701)

Adjustment for adoption of new accounting

policy [note 1] –1,754 –

Reduction on Class B Non-Voting Shares

purchased for cancellation [note 11] (25,017) (74,963) (82,702)

Dividends – Class A Shares and Class B Non-

Voting Shares (351,883) (303,813) (201,208)

Retained earnings (deficit), end of year 384,747 226,408 (68,132)

Earnings per share [note 11]

Basic $ 1.25 $ 1.56 $ 0.90

Diluted $ 1.24 $ 1.55 $ 0.89

See accompanying notes

58