Shaw 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

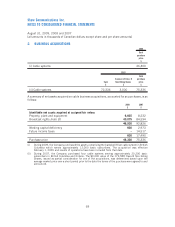

Burrard Landing Lot 2 Holdings Partnership

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project with

office/retail space and living/working space in Vancouver, BC. In the fall of 2004, the commercial

construction of the building was completed and at that time, the Partnership issued 10 year secured

mortgage bonds in respect of the commercial component of the Shaw Tower. The bonds bear

interest at 6.31% compounded semi-annually and are collateralized by the property and the

commercial rental income from the building with no recourse to the Company.

Debt retirement costs

In connection with the aforementioned early redemption of the Videon Cablesystems Inc.

Cdn$130,000 Senior Debentures, the Company incurred costs of $9,161 and wrote-off the

remaining unamortized fair value adjustment of $906.

On January 30, 2008, the Company redeemed its $100,000 8.54% Canadian Originated Preferred

Securities (“COPrS”). In connection with this early redemption, the Company incurred costs of

$4,272 and wrote-off the remaining unamortized financing charges of $992.

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of the

credit agreements and trust indentures described above. The Company and its subsidiaries were in

compliance with these covenants at August 31, 2009.

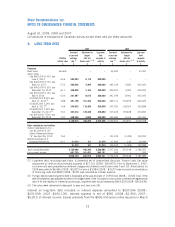

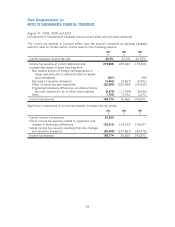

Long-term debt repayments

Mandatory principal repayments on all long-term debt in each of the next five years and thereafter

are as follows:

At year-end

exchange rate

$

Exchange rate

adjusted for

hedged rates

$

2010 482,341 643,161

2011 246,951 356,414

2012 329,113 477,463

2013 450,652 450,652

2014 950,694 950,694

Thereafter 718,498 718,498

3,178,249 3,596,882

75

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]