Shaw 2009 Annual Report Download - page 104

Download and view the complete annual report

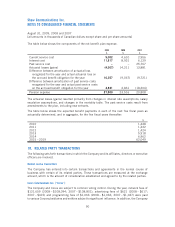

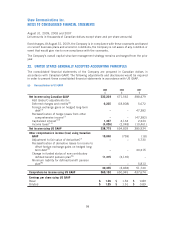

Please find page 104 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Deferred charges and credits

The excess of equipment costs over equipment revenues are deferred and amortized under

Canadian GAAP. Under US GAAP, these costs are expensed as incurred.

For US GAAP, transaction costs, financing costs and proceeds on bond forward contracts

associated with the issuance of debt securities and fair value adjustments on debt assumed in

business acquisitions are recorded as deferred charges and deferred credits and amortized to

income on a straight-line basis over the period to maturity of the related debt. Effective

September 1, 2007 for Canadian GAAP, such amounts are recorded as part of the principal

balance of debt and amortized to income using the effective interest rate method.

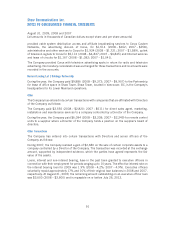

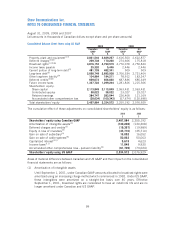

(3) Foreign exchange gains on hedged long-term debt

Until September 1, 2007, foreign exchange gains on translation of hedged long-term debt

were deferred under Canadian GAAP but included in income for US GAAP. Effective

September 1, 2007, these foreign exchange gains are included in income for Canadian GAAP.

(4) Equity in loss of investees

The earnings of investees determined under Canadian GAAP have been adjusted to reflect US

GAAP.

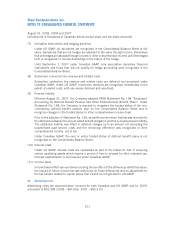

Under Canadian GAAP, the investment in Star Choice was accounted for using the cost

method until CRTC approval was received for the acquisition. When the Company received

CRTC approval, the amount determined under the cost method became the basis for the

purchase price allocation and equity accounting commenced. Under US GAAP, equity

accounting for the investment was applied retroactively to the date the Company first

acquired shares in Star Choice.

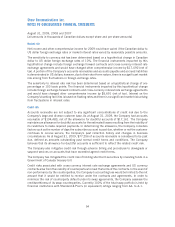

(5) Gain on sale of subsidiary

In 1997, the Company acquired a 54% interest in Star Choice in exchange for the shares of

HomeStar Services Inc., a wholly-owned subsidiary at that time. Under Canadian GAAP, the

acquisition of the investment in Star Choice was a non-monetary transaction that did not

result in the culmination of the earnings process, as it was an exchange of control over similar

productive assets. As a result, the carrying value of the Star Choice investment was recorded

at the book value of assets provided as consideration on the transaction. Under US GAAP, the

transaction would have been recorded at the fair value of the shares in HomeStar Services Inc.

This would have resulted in a gain on disposition of the consideration the Company exchanged

for its investment in Star Choice and an increase in the acquisition cost for Star Choice.

(6) Gain on sale of cable systems

The gain on sale of cable systems determined under Canadian GAAP has been adjusted to

reflect the lower net book value of broadcast rights under US GAAP as a result of item

(1) adjustments.

Under Canadian GAAP, no gain was recorded in 1995 on an exchange of cable systems with

Rogers Communications Inc. on the basis that this was an exchange of similar productive

assets. Under US GAAP the gain net of applicable taxes is recorded and amortization adjusted

as a result of the increase in broadcast rights upon the recognition of the gain.

100

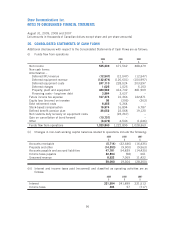

Shaw Communications Inc.

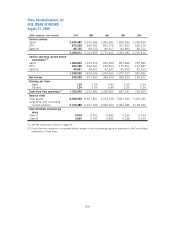

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]