Shaw 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(d) Recent accounting pronouncements

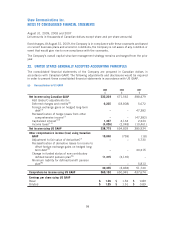

Business Combinations

Effective September 1, 2009, the Company will adopt SFAS 141R “Business Combinations”. This

revised statement requires assets and liabilities acquired in a business combination, contingent

consideration, and certain acquired contingencies to be measured at their fair values as of the date

of acquisition. In addition, acquisition-related and restructuring costs are to be recognized

separately from business combinations, generally as expenses.

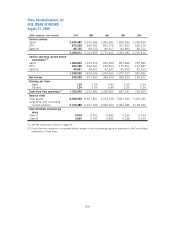

23. COMPARATIVE CONSOLIDATED FINANCIAL STATEMENTS

Certain of the comparative figures have been reclassified to conform to the presentation adopted in

the current year.

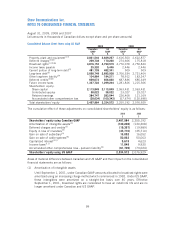

24. SUBSEQUENT EVENTS

Subsequent events have been evaluated through to November 30, 2009 which is the date the

consolidated financial statements were issued.

Late in fiscal 2008 the Company participated in the Canadian Advanced Wireless Spectrum

(“AWS”) auction and was successful in acquiring 20 megahertz of spectrum across most of its cable

footprint for a cost of $190,912. In early September 2009, the Company received its ownership

compliance decision from Industry Canada and was granted its AWS licenses.

In September 2009, the Company announced its intention to redeem all of its outstanding US

$440,000 8.25% senior notes due April 11, 2010 and US $225,000 7.25% senior notes due

April 6, 2011. The redemption date was October 13, 2009. On October 2, 2009, the Company

announced its intention to redeem all of its outstanding US $300,000 7.20% senior notes due

December 15, 2011. The redemption date was October 20, 2009. In conjunction with the

redemption of the US senior notes, the Company unwound and settled a portion of the principal

component of two of the associated cross-currency interest rate swaps. The Company

simultaneously entered into offsetting currency swap transactions for the outstanding notional

principal amounts under all the remaining cross-currency interest rate swap agreements.

Pursuant to the short form base shelf prospectus filed on March 11, 2009, on October 1, 2009, the

Company issued $1,250,000 of senior notes at a rate of 5.65% due 2019. Estimated net proceeds

(after issuance at a discount of $3,960 and issue and underwriting expenses) of $1,240,000 were

used for the aforementioned notes redemptions.

On October 7, 2009, the Government of Canada and members of the broadcasting industry that are

required to pay Part II license fees announced they had entered into an agreement on the Part II

license fee issue. The agreement has resulted in the government agreeing that it will not seek Part II

license fees for the past three years that were not collected due to the ongoing legal dispute. In

return, members of the broadcasting industry, including the Company, discontinued their appeal

before the Supreme Court of Canada challenging the validity of the fees. Under the settlement, the

government is also recommending that the CRTC develop a new forward-looking regime that would

be capped at $100,000 per year, indexed to inflation. In October 2009 the Company recorded a

recovery of approximately $52,000 after taxes for the Part II license fees that had been accrued for

the past three years and will not be collected by the government.

104

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]