Shaw 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

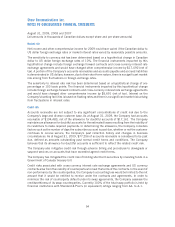

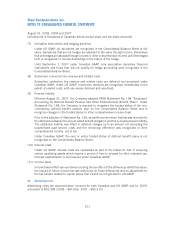

fixed charges. At August 31, 2009, the Company is in compliance with these covenants and based

on current business plans and economic conditions, the Company is not aware of any condition or

event that would give rise to non-compliance with the covenants.

The Company’s overall capital structure management strategy remains unchanged from the prior

year.

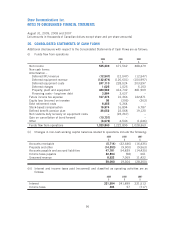

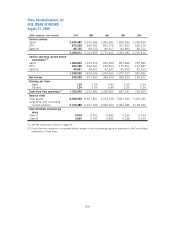

22. UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

The consolidated financial statements of the Company are prepared in Canadian dollars in

accordance with Canadian GAAP. The following adjustments and disclosures would be required

in order to present these consolidated financial statements in accordance with US GAAP.

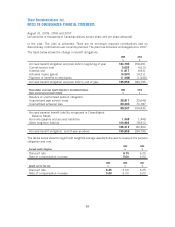

(a) Reconciliation to US GAAP

2009

$

2008

$

2007

$

Net income using Canadian GAAP 535,239 671,562 388,479

Add (deduct) adjustments for:

Deferred charges and credits

(2)

6,235 (18,808) 5,672

Foreign exchange gains on hedged long-term

debt

(3)

–– 47,382

Reclassification of hedge losses from other

comprehensive income

(7)

–– (47,382)

Capitalized interest

(10)

1,337 4,133 2,244

Income taxes

(11)

(4,036) (2,048) (10,461)

Net income using US GAAP 538,775 654,839 385,934

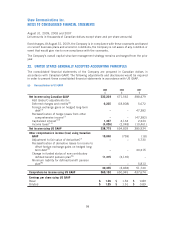

Other comprehensive income (loss) using Canadian

GAAP 19,040 (759) (18)

Adjustment to fair value of derivatives

(7)

–– 5,730

Reclassification of derivative losses to income to

offset foreign exchange gains on hedged long-

term debt

(7)

–– 40,215

Change in funded status of non-contributory

defined benefit pension plan

(9)

11,315 (3,135) –

Minimum liability for defined benefit pension

plan

(9)

–– 5,813

30,355 (3,894) 51,740

Comprehensive income using US GAAP 569,130 650,945 437,674

Earnings per share using US GAAP

Basic $ 1.26 $ 1.52 $ 0.89

Diluted $ 1.25 $ 1.51 $ 0.89

98

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]