Shaw 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

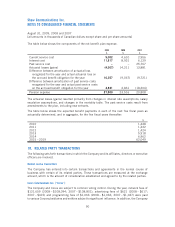

Options to purchase 23,714,667 Class B Non-Voting Shares were outstanding under the

Company’s stock option plan at August 31, 2009 (2008 – 23,963,771; 2007 – 17,574,801).

In addition, Satellite Services options and warrants to issue 33,602 Class B Non-Voting Shares

were outstanding at August 31, 2007 and the Company had the right to issue Class B Non-Voting

Shares in satisfaction of its redemption obligations on the COPrS included in long-term debt at

August 31, 2007.

12. OTHER COMPREHENSIVE INCOME (LOSS) AND ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

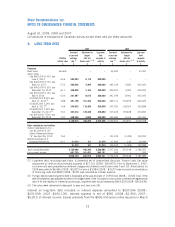

Components of other comprehensive income (loss) and the related income tax effects for 2009 are

as follows:

Amount

$

Income Taxes

$

Net

$

Change in unrealized fair value of derivatives designated as

cash flow hedges 26,693 (4,105) 22,588

Proceeds on cancellation of forward purchase contracts 13,384 (4,070) 9,314

Adjustment for hedged items recognized in the period 14,518 (75) 14,443

Reclassification of foreign exchange gain on hedging

derivatives to income to offset foreign exchange loss on

US denominated debt (31,845) 4,509 (27,336)

Unrealized foreign exchange gain on translation of a self-

sustaining foreign operation 31 – 31

22,781 (3,741) 19,040

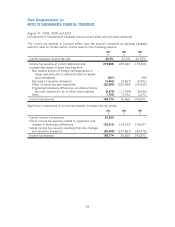

Components of other comprehensive income (loss) and the related income tax effects for 2008 are

as follows:

Amount

$

Income Taxes

$

Net

$

Change in unrealized fair value of derivatives designated

as cash flow hedges (43,327) 7,134 (36,193)

Adjustment for hedged items recognized in the period 49,801 (9,578) 40,223

Reclassification of foreign exchange gain on hedging

derivatives to income to offset foreign exchange loss on

US denominated debt (5,597) 801 (4,796)

Unrealized foreign exchange gain on translation of a self-

sustaining foreign operation 7 – 7

884 (1,643) (759)

80

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]