Shaw 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

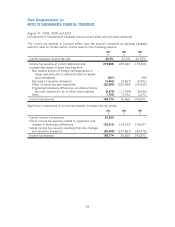

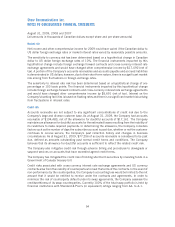

The table below shows the components of the net benefit plan expense.

2009

$

2008

$

2007

$

Current service cost 5,002 4,610 2,956

Interest cost 11,817 8,931 6,129

Past service cost –– 25,767

Actuarial losses (gains) (4,507) 14,211 13,881

Difference between amortization of actuarial loss

recognized for the year and actual actuarial loss on

the accrued benefit obligation for the year 10,357 (9,067) (9,721)

Difference between amortization of past service costs

recognized for the year and actual past service costs

on the accrued benefit obligation for the year 4,831 4,831 (18,204)

Pension expense 27,500 23,516 20,808

The actuarial losses (gains) resulted primarily from changes in interest rate assumptions, salary

escalation assumptions, and changes in the mortality table. The past service costs result from

amendments to the plan, including new entrants.

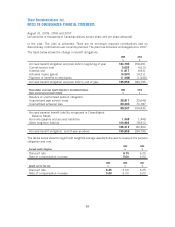

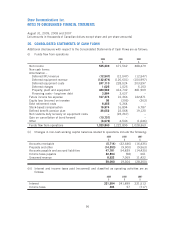

The table below shows the expected benefit payments in each of the next five fiscal years as

actuarially determined, and in aggregate, for the five fiscal years thereafter:

$

2010 1,448

2011 1,432

2012 1,424

2013 5,918

2014 6,962

2015 – 2019 62,049

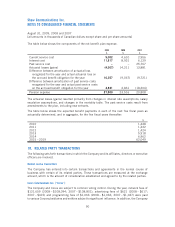

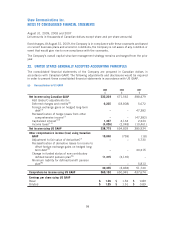

18. RELATED PARTY TRANSACTIONS

The following sets forth transactions in which the Company and its affiliates, directors or executive

officers are involved.

Normal course transactions

The Company has entered into certain transactions and agreements in the normal course of

business with certain of its related parties. These transactions are measured at the exchange

amount, which is the amount of consideration established and agreed to by the related parties.

Corus Entertainment Inc. (“Corus”)

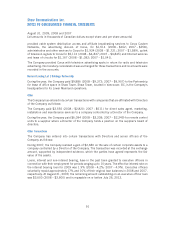

The Company and Corus are subject to common voting control. During the year, network fees of

$121,659 (2008 – $108,094; 2007 – $108,801), advertising fees of $621 (2008 – $617;

2007 – $415) and programming fees of $1,066 (2008 – $1,062; 2007 – $1,047) were paid

to various Corus subsidiaries and entities subject to significant influence. In addition, the Company

90

Shaw Communications Inc.

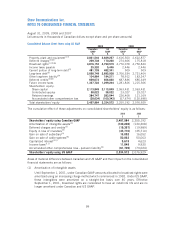

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]