Shaw 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

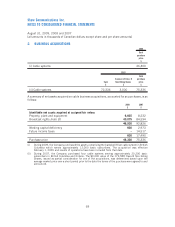

10. DEFERRED CREDITS

Amount

$

Accumulated

amortization

$

Net book

value

$

Amount

$

Accumulated

amortization

$

Net book

value

$

2009 2008

IRU prepayments 629,119 106,705 522,414 629,119 94,158 534,961

Equipment revenue 406,609 280,598 126,011 392,458 252,027 140,431

Connection fee and installation revenue 23,619 17,560 6,059 33,247 24,403 8,844

Deposit on future fibre sale 2,000 – 2,000 2,000 – 2,000

Other 2,589 – 2,589 1,600 – 1,600

1,063,936 404,863 659,073 1,058,424 370,588 687,836

Amortization of deferred credits for 2009 amounted to $153,168 (2008 – $150,366; 2007 –

$132,819) and was recorded in the accounts as described below.

IRU agreements are in place for periods ranging from 21 to 60 years and are being amortized to

income over the agreement periods. Amortization in respect of the IRU agreements for 2009

amounted to $12,547 (2008 – $12,547; 2007 – $12,547). Amortization of equipment revenue

for 2009 amounted to $132,974 (2008 – $126,601; 2007 – $104,997). Amortization of

connection fee and installation revenue for 2009 amounted to $7,647 (2008 – $11,218;

2007 – $14,250) and was recorded as service revenue. In 2007, amortization of $1,025, in

respect of a fair value adjustment on debt and bond forward proceeds, was offset against interest

expense.

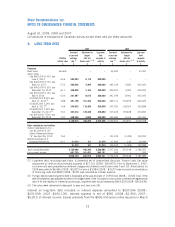

11. SHARE CAPITAL

Authorized

The Company is authorized to issue a limited number of Class A voting participating shares

(“Class A Shares”) of no par value, as described below, an unlimited number of Class B non-voting

participating shares (“Class B Non-Voting Shares”) of no par value, Class 1 preferred shares,

Class 2 preferred shares, Class A preferred shares and Class B preferred shares.

The authorized number of Class A Shares is limited, subject to certain exceptions, to the lesser of

that number of shares (i) currently issued and outstanding and (ii) that may be outstanding after any

conversion of Class A Shares into Class B Non-Voting Shares.

2009 2008

2009

$

2008

$

Number of securities

22,520,064 22,550,064 Class A Shares 2,468 2,471

407,717,782 405,882,652 Class B Non-Voting Shares 2,111,381 2,060,960

430,237,846 428,432,716 2,113,849 2,063,431

Class A Shares and Class B Non-Voting Shares

Class A Shares are convertible at any time into an equivalent number of Class B Non-Voting Shares.

In the event that a take-over bid is made for Class A Shares, in certain circumstances, the Class B

Non-Voting Shares are convertible into an equivalent number of Class A Shares.

76

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]