Shaw 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Highlights

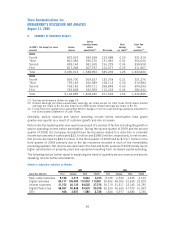

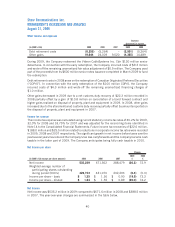

kNet income was $535.2 million for the year compared to $671.6 million in 2008 and

$388.5 million in 2007.

kEarnings per share were $1.25 compared to $1.56 in 2008 and $0.90 in 2007.

kService revenue for the year improved 9.2% to $3.39 billion from $3.10 billion last year

and $2.77 billion in 2007.

kService operating income before amortization of $1.54 billion was up 9.3% over last

year’s amount of $1.41 billion and $1.24 billion in 2007.

kConsolidated free cash flow increased to $504.4 million from $452.6 million in 2008

and $356.2 million in 2007.

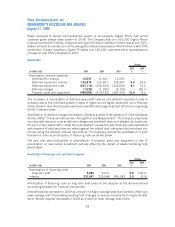

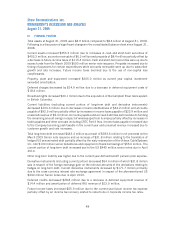

kDuring 2009, the Company increased the dividend rate on Shaw’s Class A Participating

Shares and Class B Non-Voting Participating Shares to an equivalent dividend rate of

$0.84 and $0.8375, respectively. Dividends paid in 2009 increased almost 16% over

2008 to $352 million.

kOn March 27, 2009 the Company closed a $600 million offering of 6.50% senior notes

due June 2, 2014 and on April 15, 2009 Shaw redeemed $130.0 million of Videon

CableSystems Inc. senior debentures.

kThe Company repurchased for cancellation 1,683,000 Class B Non-Voting Shares for

$33.6 million during 2009.

kIn October 2009 the Company closed a $1.25 billion offering of 5.65% senior notes

due October 1, 2019. The net proceeds were used to repay near maturing debt

including its US$440 million senior notes, US$255 million senior notes, and

US$300 million senior notes.

kMost recently on November 9, 2009, the Company issued $650 million senior notes at

a rate of 6.75% due 2039. Estimated net proceeds (after issuance at a discount of

$4.4 million and issue and underwriting expenses) of $642 million will be used for

general corporate purposes, working capital, capital expenditures and wireless

investments.

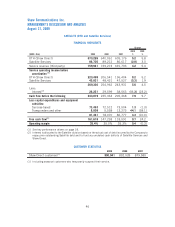

Revenue and operating expenses

2009 vs. 2008

Consolidated service revenue of $3.39 billion for the year improved 9.2% over the prior year. The

improvement was primarily due to customer growth and rate increases. Consolidated service

operating income before amortization improved 9.3% over the comparable period to $1.54 billion.

The increase was driven by the revenue improvements partially offset by higher employee and other

costs related to growth.

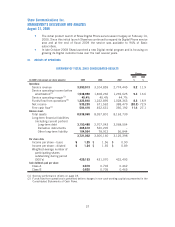

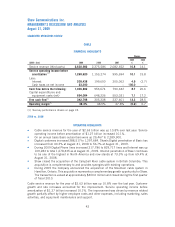

Throughout 2009 subscriber growth was solid. The Company’s focus on Digital deployment,

combined with the consumers increased demand for HDTV, drove record Digital growth during

the year. Shaw added over 388,000 new subscribers increasing its Digital penetration of Basic from

40% at August 31, 2008 to almost 57% at August 31, 2009.

2008 vs. 2007

Consolidated service revenue of $3.10 billion for 2008 improved 11.9% over 2007. The increase

was primarily due to customer growth and rate increases. Consolidated service operating income

before amortization was up 13.6% over the comparable period to $1.41 billion. The increase was

driven by the revenue improvements partially offset by higher employee and other costs related to

growth.

38

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009