Shaw 2009 Annual Report Download - page 52

Download and view the complete annual report

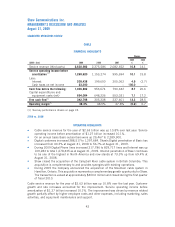

Please find page 52 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.IV. FINANCIAL POSITION

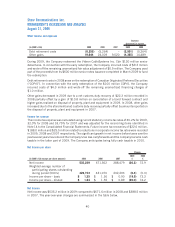

Total assets at August 31, 2009 were $8.9 billion compared to $8.4 billion at August 31, 2008.

Following is a discussion of significant changes in the consolidated balance sheet since August 31,

2008.

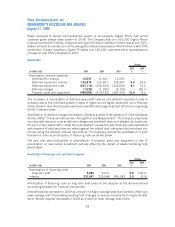

Current assets increased $353.2 million due to increases in cash and short-term securities of

$453.2 million, accounts receivable of $6.3 million and prepaids of $8.4 million partially offset by

a decrease in future income taxes of $115.3 million. Cash and short-term securities were up due to

excess funds from the March 2009 $600 million senior note issuance. Prepaids increased due to

timing of payments for certain expenditures while accounts receivable were up due to subscriber

growth and rate increases. Future income taxes declined due to the use of non-capital loss

carryforwards.

Property, plant and equipment increased $205.0 million as current year capital investment

exceeded amortization.

Deferred charges decreased by $14.9 million due to a decrease in deferred equipment costs of

$18.4 million.

Broadcast rights increased $40.1 million due to the acquisition of the Campbell River cable system

in British Columbia.

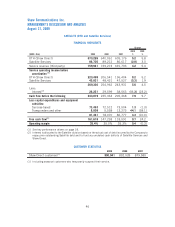

Current liabilities (excluding current portion of long-term debt and derivative instruments)

decreased $104.6 million due to decreases in bank indebtedness of $44.2 million and accounts

payable of $92.6 million partially offset by increases in income taxes payable of $22.9 million and

unearned revenue of $9.4 million. Accounts payable and accrued liabilities declined due to funding

the remaining amount owing in respect of wireless spectrum licenses partially offset by increases in

trade payables and other accruals including CRTC Part II fees. Income taxes payable increased due

to the Company becoming cash taxable in the current year and unearned revenue increased due to

customer growth and rate increases.

Total long-term debt increased $443.4 million as a result of $593.6 million in net proceeds on the

March 2009 Senior note issuance and an increase of $31.8 million relating to the translation of

hedged US denominated debt partially offset by the early redemption of the Videon CableSystems

Inc. Cdn $130 million senior debentures and repayment of bank borrowings of $55.0 million. The

current portion of long-term debt increased due to the US $440 million senior notes due in April

2010.

Other long-term liability was higher due to the current year defined benefit pension plan expense.

Derivative instruments (including current portion) decreased $54.6 million of which $31.8 million

was in respect of the foreign exchange gain on the notional amounts of the derivatives relating to

hedges on long-term debt. Current derivative instruments increased by $171.7 million primarily

due to the cross-currency interest rate exchange agreement in respect of the aforementioned US

$440 million Senior notes due in April 2010.

Deferred credits decreased $28.8 million due to a decrease in deferred equipment revenue of

$14.4 million and amortization of deferred IRU revenue of $12.5 million.

Future income taxes increased $55.9 million due to the current year future income tax expense

partially offset by an income tax recovery related to reductions in corporate income tax rates.

48

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2009