Shaw 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 was held in cash and short-term securities and a portion of the proceeds from the $400,000

senior notes issuance in March 2007 was invested in short term investments pending the

repayment of maturing debt in October 2007.

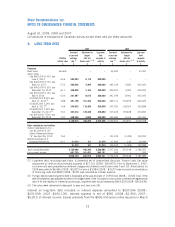

Corporate

Bank loans

The Company has a $50,000 revolving operating loan facility, of which $627 has been drawn as

committed letters of credit. Interest rates and borrowing options are principally the same as those

contained in the credit facility described below. The effective interest rate on the facility was 3.09%

for the year (2008 – 5.49%; 2007 – 6.03%).

A syndicate of banks has provided the Company with an unsecured $1 billion credit facility due in

May 2012. At August 31, 2009, no amounts were drawn under the credit facility. Funds are

available to the Company in both Canadian and US dollars. Interest rates fluctuate with Canadian

bankers’ acceptance rates, US bank base rates and LIBOR rates. The effective interest rate on

actual borrowings during the year averaged 3.06% (2008 – 4.81%; 2007 – 5.04%).

Senior notes

The senior notes are unsecured obligations and rank equally and ratably with all existing and future

senior indebtedness. The notes are redeemable at the Company’s option at any time, in whole or in

part, prior to maturity at 100% of the principal amount plus a make-whole premium.

On March 27, 2009, the Company issued $600,000 of senior notes at a rate of 6.50%. The senior

notes were issued at a discount and the effective interest rate is 6.56%.

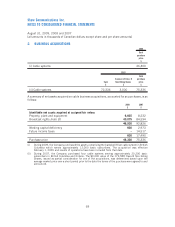

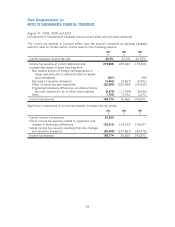

The Company has entered into cross-currency interest rate agreements to fix the liability for interest

and principal payments over the life of the US dollar senior notes. The table below outlines the US

dollar principal, the interest coupon rate, the effective interest rate on the Canadian dollar

equivalent of the US debt as a result of the agreements, and the exchange rate applicable to

the principal portion of the debt (“Exchange rate”):

US senior

note principal

$

Coupon rate

%

Effective

interest rate

%

Exchange rate

Cdn $ vs US$

440,000 8.25 7.88 1.4605

225,000 7.25 7.68 1.5815

300,000 7.20 7.61 1.5895

Other subsidiaries and entities

Videon CableSystems Inc. (“Videon”)

On April 15, 2009, the Company redeemed the Videon Cablesystems Inc. Cdn$130,000 Senior

Debentures which were due April 26, 2010.

The debentures were unsecured and non-recourse to the parent company and were guaranteed by

the subsidiaries of Videon. The effective interest rate on the debentures was 7.63% after giving

effect to the fair value adjustment to the debt at the date of the Moffat acquisition.

74

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2009, 2008 and 2007

[all amounts in thousands of Canadian dollars except share and per share amounts]