Samsung 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

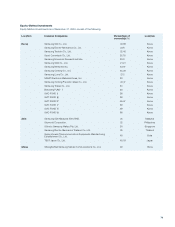

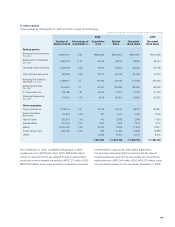

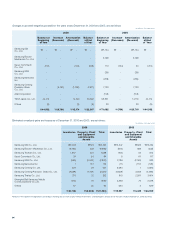

Collection schedule of installment finance and general loans as of

December 31, 2006, are as follows:

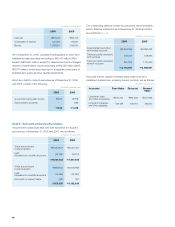

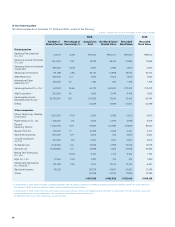

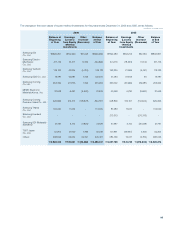

Finance lease of financing receivables, as of December 31, 2006,

are as follows:

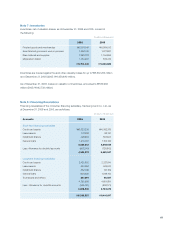

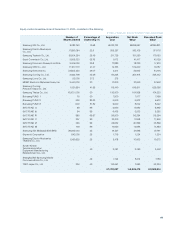

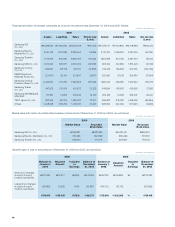

The minimum lease receipts relating to operating lease agreement

as of December 31, 2006 and 2005, are as follows:

As of December 31, 2006 and 2005, property on operating lease

is classified as follows:

Year Installment finance General loans

2007 \448,653 \1,210,031

2008 192,833 274,414

2009 129,966 203,343

2010 20,025 96,332

2011 8,805 28,516

Thereafter 420 3,725

\800,702 \1,816,361

Minimum

lease

payment

Present

values

Within one year \34,705 \31,147

From one year to five years 213,948 168,167

More than five years 1,560 1,148

Unguaranteed residual value 29,279 25,606

279,492 \226,068

Present value adjustment (53,424)

Financing lease receivables \226,068

2006 2005

Automobiles \688,021 \571,810

Electronic system 14,390 14,226

702,411 586,036

Less: Accumulated depreciation 204,652 158,234

Accumulated impairment

losses 854 -

Operating lease assets \496,905 \427,802

(In millions of Korean won)

The outstanding balance of financing receivables sold to financial

institutions as of December 31, 2006 and 2005,

are as follows (Note 19):

Furthermore, from 2003 to 2005, Samsung Card Co., Ltd.

transferred credit card receivables and financial assets to

SangRokSoo 1st Securitization Specialty Co., Ltd., Badbank

Harmony Co., Ltd. and Badbank Heemangmoah Securitization

Specialty Co., Ltd. in accordance with the “personal credit

rehabilitation” program in exchange for cash, preferred stock and

subordinated bonds. The preferred stock is recorded as available-

for-sale securities and the subordinated bonds are recorded as

held-to-maturity securities.

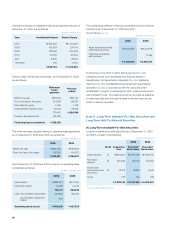

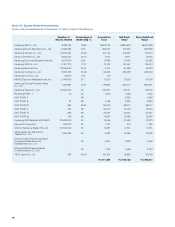

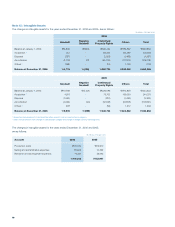

Note 9 : Long-Term Available-For-Sale Securities and

Long-Term Held-To-Maturity Securities

(1) Long-Term Available-For-Sale Securities

Long-term available-for-sale securities as of December 31, 2006

and 2005, consist of the following:

2006 2005

Asset-backed securities

with limited recourse \4,002,923 \4,017,978

Financing receivables

with recourse - 17,395

\4,002,923 \4,035,373

2006 2005

Detail Acquisition

Cost

Recorded

Book Value

Recorded

Book Value

Listed equities ¹(1) \601,961 \1,810,756 \1,581,740

Non-listed

equities ¹(2) 615,839 729,190 645,150

Government

and public bonds

and others

(3) 18,178 16,903 5,543

Funds 168 155 168

\1,236,146 \2,557,004 \2,232,601

(In millions of Korean won)

2006 2005

Within one year \192,193 \166,600

From one year to five years 163,158 164,027

\355,351 \330,627

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

¹ Excludes equity-method investees.