Samsung 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

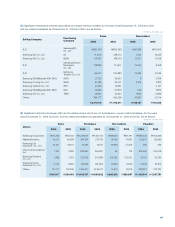

Basic earnings per share for the years ended December 31, 2006

and 2005, are calculated as follows:

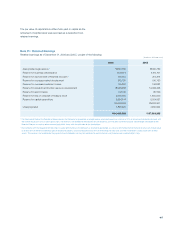

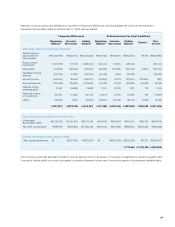

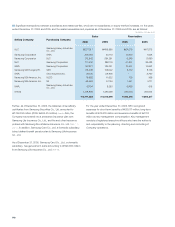

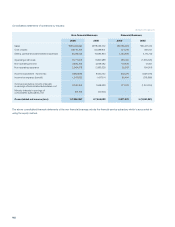

Temporary differences, which were not recognized to deferred tax

effect due to the uncertainty regarding ultimate ability to realize

such assets, as of December 31, 2006 and 2005, are as follows:

2006 2005

Gain on revaluation of land ¹\399,034 \411,691

Gain on valuation on equity-method

investments ²253,358 236,383

Undisposed accumulated deficit 2,457,237 2,558,846

Tax credit carryforwards 318,588 293,983

Others 136,034 106,593

¹ The Company does not expect cash inflows from the revalued land in the near future.

² The Company does not expect cash inflows, such as proceeds from the disposal of, or

receipts of dividends from, earnings arising from certain subsidiaries and equity method

investments within the foreseeable future.

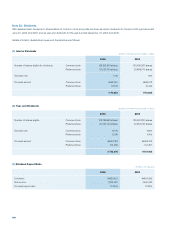

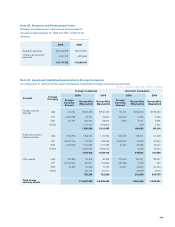

Deferred income tax assets and liabilities and income tax expense

charged directly to shareholders’ equity as of and for the years

ended December 31, 2006 and 2005, are as follows:

2006 2005

Ⅰ

. Deferred income tax assets

and liabilities

Gain(Loss) on valuation of

available-for-sale securities \(355,117) \(210,876)

Ⅱ

. Income tax expense

Gain on sale of treasury stock \(7,394) \(10,113)

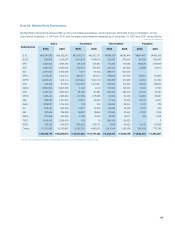

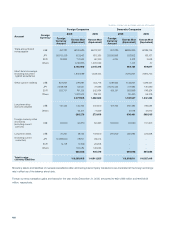

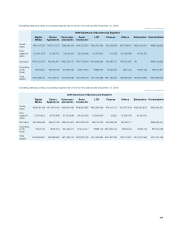

Note 27 : Earnings Per Share

Earnings per share is computed by dividing net income by the

weighted-average number of common shares outstanding during

the year. Ordinary income per share is calculated by dividing

ordinary income allocated to common stock, which is net income

allocated to common stock as adjusted by extraordinary gains

or losses, net of related income taxes, by the weighted-average

number of common shares outstanding during the year.

2006 2005

Net income as reported

on the statements of income \7,926,087 \7,640,092

Adjustments:

Dividends for preferred stock (112,408) (114,735)

Undeclared participating

preferred stock dividend (965,779) (929,242)

Net income available

for common stock 6,847,900 6,596,115

Weighted-average number of

common shares outstanding 129,499,781 132,003,416

Earnings per share (in Korean won) \52,880 \49,969

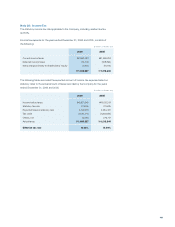

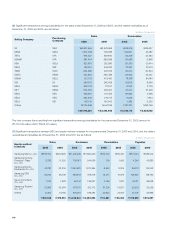

Diluted earnings per share for the years ended December 31, 2006

and 2005, are calculated as follows:

2006 2005

Net income available

for common stock \6,847,900 \6,596,115

Adjustment:

Compensation expense

for stock options - 2,437

Net income available for common

stock and common equivalent shares 6,847,900 6,598,552

Weighted-average number of shares

of common stock and common

equivalent shares ¹ outstanding

131,388,160 134,314,164

Diluted earnings per share

(in Korean won) \52,120 \49,128

1 Common equivalent shares:

2006

Number of

shares

Weight Common Stock

Equivalent

Stock options 1,888,379 365/365 1,888,379

2005

Number of

shares

Weight Common Stock

Equivalent

Stock options 2,310,748 365/365 2,310,748

The number of dilutive shares of outstanding stock options is

calculated by applying the treasury stock method.

Under the treasury stock method, the proceeds from the exercise

of the stock options are assumed to be used to purchase common

stock at the average market price. The incremental number of

shares which is the difference between the number of shares

assumed to be issued and the number of shares assumed to be

purchased, is included in the denominator in calculating diluted

earnings per share.

(In millions of Korean won)

(In millions and number of shares)

(In millions of Korean won)

(In millions and number of shares)