Samsung 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

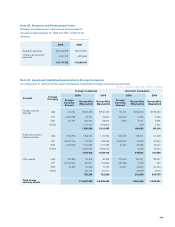

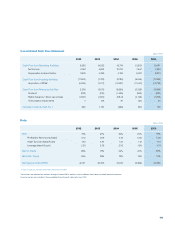

2006 2005

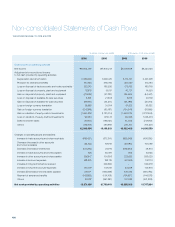

Write-off of accounts receivables and financing receivables \1,473,054 \1,846,815

Gain on valuation of available-for-sale securities 297,605 818,877

Loss on valuation of available-for-sale securities (4,632) (7,551)

Decrease in gain on valuation of available-for-sale

securities due to disposal 4,543 19,319

Decrease in loss on valuation of available-for-sale-

securities due to disposal 32,450 1,618

Deferred tax effects applicable to gain on valuation

of investment securities 81,516 276,552

Deferred tax effects applicable to loss on valuation

of investment securities 8,191 8,924

Reclassification of long-term available-for-sale

securities to short-term available-for-sale securities - 13,679

Reclassification of long-term held-to-maturity

securities to short-term held-to-maturity securities 222 127,631

Current maturities of long-term prepaid expenses 193,860 143,379

Reclassification of construction-in-progress and

machinery in transit to other property,

plant and equipment accounts

10,844,486 9,845,250

Current maturities of long-term debts 2,317,933 3,814,535

Current maturities of long-term advances received 165,917 -

Current maturities of other long-term liabilities 332,435 187,034

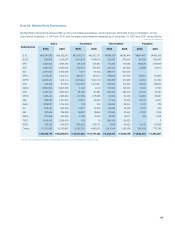

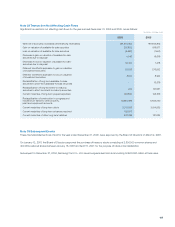

Note 32 Transaction Not Affecting Cash Flows

Significant transactions not affecting cash flows for the years ended December 31, 2006 and 2005, are as follows:

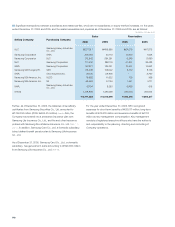

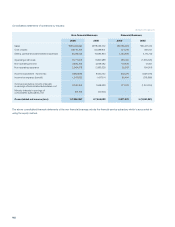

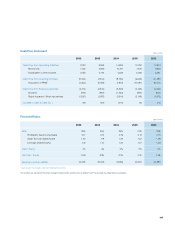

These financial statements as of and for the year ended December 31, 2006, were approved by the Board of Directors on March 2, 2007.

On January 12, 2007, the Board of Directors approved the purchase of treasury stocks consisting of 2,800,000 common shares and

400,000 preferred shares between January 16, 2007 and April 15, 2007, for the purpose of stock price stabilization.

Subsequent to December 31, 2006, Samsung Card Co., Ltd. issued unguaranteed bonds amounting to \70,000 million at face value.

Note 33 Subsequent Events

(In millions of Korean won)