Samsung 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

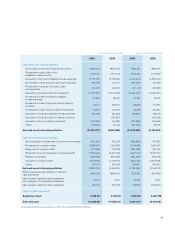

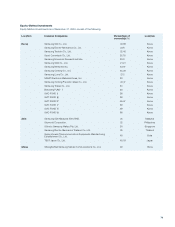

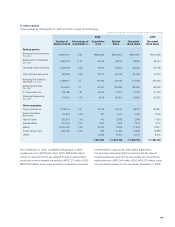

Intangible Assets

Intangible assets are amortized on a straight-line basis over the

following estimated useful lives:

Leases

The Company accounts for lease transactions as either operating

lease or finance lease, depending on the terms of the lease

agreement. A finance lease is a lease that transfers substantially

all the risks and rewards incidental to ownership of an asset, while

an operating lease is a lease other than a finance lease.

In addition, the lesser between the present value of minimum lease

payments and the fair value of the lease asset is recognized as

the value of the capital lease asset or liability. The costs incurred

during lease inception process are also recognized as part other

capital lease cost.

In case of operating lease as lessor, the lease assets are

recognized as tangible or intangible assets depending on

the nature of the leased assets. The operating lease assets are

depreciated using the same depreciation method used for other

similar assets held by the Company. In addition, the annual

minimum lease payments, less guaranteed residual value,

are recognized as income on a constant basis over the lease term,

unless another reasonable basis is used. In case of operating

lease as lessee, the annual minimum lease payments, less

guaranteed residual value, are charged to expense on a constant

basis over the lease term, unless another reasonable basis

is used.

In case of finance lease as lessor, the Company recognizes

the amount equivalent to the net investment in the lease asset as

capital lease receivable. The costs incurred during lease inception

process are recognized as capital lease receivable. The lease

payments received are recognized as collection of capital lease

receivable and interest income, determined using the effective

interest rate.

In case of finance lease as lessee, annual minimum lease

payments, excluding residual value, are allocated to interest

expense or for the redemption of capital lease liability using

the effective interest method. Machinery and equipment acquired

under capital lease agreements are recorded as property,

plant and equipment at cost and depreciated using the same

depreciation method as that of other similar assets held by

the Company. If it is certain that the Company is expected to

Estimated useful lives

Goodwill 5 years

Intellectual property rights 10 years

Other intangible assets 5 years

obtain ownership of the lease asset upon or before maturity of

the lease term, the lease asset is depreciated over its useful life.

Otherwise, it is depreciated over its useful life or the term of

the lease, whichever is shorter. The acquisition cost of the lease

asset, less any expected or guaranteed residual value, is subject

to deprecation.

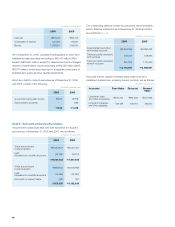

Discounts and Premiums on Debentures

The difference between the value amount and the proceeds on

issuance of a debenture is treated as either a discount or premium

on the debenture, which is amortized over the term of the

debenture using the effective interest rate method. The discount

or premium is reported in the balance sheet as a direct deduction

from or addition to the face value of the debenture. Amortization

of the discount or premium is treated as part of interest expense.

Convertible Bonds

The Company separately recognizes the value of conversion

rights when issuing convertible bonds. The conversion rights

compensation, which is calculated by deducting the present

value of general bonds from the issue price of convertible bonds,

is stated as capital surplus. The conversion rights adjustment is

deducted from the par value and the put premium is added to

the par value of convertible bonds. Amortization of the conversion

right adjustment is treated as part of interest expense over

the term of the bonds using effective interest rate method.

However, for convertible bonds issued before December 31, 2002,

the previous standard is applied.

Stock and Debenture Issuance Costs

Stock issuance costs are charged directly to paid-in capital in

excess of par value. Debenture issuance costs are recorded as

a reduction of the proceeds from the issuance of the debenture.

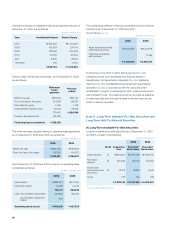

Government Grants

Government grants received for the development of certain

technologies are recorded as accrued income, and offset against

relevant development costs as incurred.

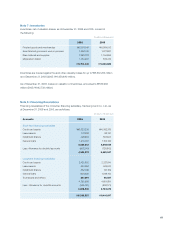

Accrued Severance Benefits

Employees and directors with at least one year of service are

entitled to receive a lump-sum payment upon termination of their

employment with SEC, its Korean subsidiaries and certain foreign

subsidiaries, based on their length of service and rate of pay at

the time of termination. Accrued severance benefits represent

the amount which would be payable assuming all eligible

employees and directors were to terminate their employment as of

the balance sheet date.