Samsung 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154

|

|

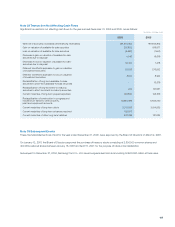

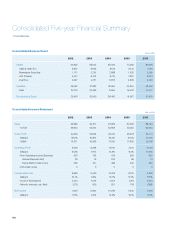

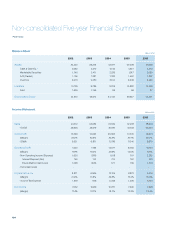

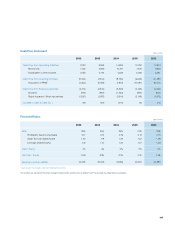

135

Cash Flow Statement

2002 2003 2004 2005 2006

Cash Flow from Operating Activities 11,193 9,848 14,804 12,790 12,874

Net Income 7,052 5,959 10,787 7,640 7,926

Depreciation & Armortization 3,156 3,761 4,526 5,060 5,681

Cash Flow from Investing Activities (8,462) (7,644) (8,792) (9,945) (10,481)

Acquisition of PP&E (4,322) (6,789) (7,870) (10,081) (9,767)

Cash Flow from Financing Activities (2,312) (2,345) (6,323) (2,749) (2,469)

Dividend (913) (887) (1,564) (834) (821)

Rights Issuance / Stock repurchase (1,500) (1,979) (3,841) (2,149) (1,813)

Increase in Cash & Cash Eq. *419 (141) (310) 96 (76)

Financial Ratios

2002 2003 2004 2005 2006

ROE 32% 22% 34% 21% 19%

Profitability (Net Income/Sales) 0.17 0.14 0.19 0.13 0.13

Asset Turnover (Sales/Asset) 1.30 1.18 1.39 1.22 1.09

Leverage (Asset/Equity) 1.42 1.37 1.30 1.27 1.28

Debt / Equity 7% 4% 0% 0% 0%

Net Debt / Equity -24% -23% -21% -17% -14%

Earnings per share (KRW) 42,005 36,356 67,899 49,970 52,880

* Cash & Cash Eq. includes short-term financial instruments

The numbers are adjusted for the latest change in Korean GAAP and thus may be different from those stated in audited financial statements

(Billion KRW)

(Billion KRW)