Samsung 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

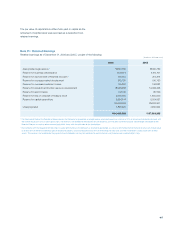

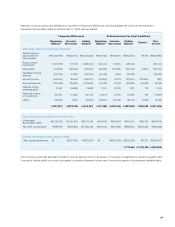

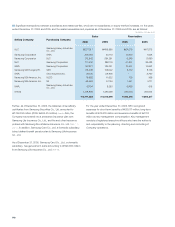

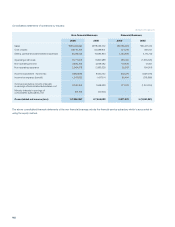

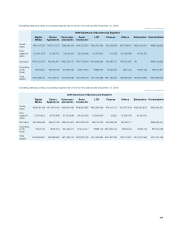

Deferred income tax assets and liabilities from tax effect of temporary differences including available tax credit carryforwards and

undisposed accumulated deficit as of December 31, 2005, were as follows:

Temporary Differences Deferred Income Tax Asset (Liabilities)

Beginning

Balance

Increase

(Decrease)

Ending

Balance

Beginning

Balance

Increase

(Decrease)

Ending

Balance Current Non-

Current

Deferred tax arising from temporary differences

Special reserves

appropriated for

tax purposes

\(1,600,489) \(453,770) \(2,054,259) \(440,153) \(123,941) \(564,094) \(110) \(563,984)

Equity-method

investments (1,451,878) 171,335 (1,280,543) (272,470) (14,674) (287,144) - (287,144)

Depreciation (241,866) (376,210) (618,076) (66,658) (117,563) (184,221) (2,494) (181,727)

Capitalized interest

expense (164,103) 24,350 (139,753) (45,128) 6,696 (38,432) - (38,432)

Accrued income (535,561) 85,944 (449,617) (147,843) 24,216 (123,627) (123,296) (331)

Accrued expenses 1,974,456 229,605 2,204,061 551,383 52,312 603,695 557,630 46,065

Deferred foreign

exchange gains 41,997 (15,369) 26,628 11,001 (3,780) 7,221 176 7,045

Impairment losses

on investments 516,557 114,655 631,212 143,105 31,725 174,830 196 174,634

Others 758,956 6,354 765,310 194,534 (40,755) 153,779 77,490 76,289

\(701,931) \(213,106) \(915,037) \(72,229) \(185,764) \(257,993) \509,592 \(767,585)

Deferred tax assets arising from the carryforwards

Undisposed

accumulated deficit \2,261,378 \1,511,806 \3,773,184 \181,130 \153,383 \334,513 \15,744 \318,769

Tax credit carryforwards \587,918 \648,566 \1,236,484 \531,845 \377,959 \909,804 \625,535 \284,269

Deferred tax relating to items charged to equity

Other capital adjustments \ - \(757,513) \(757,513) \ - \(210,876) \(210,876) \7,571 \(218,447)

\775,448 \1,158,442 \(382,994)

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a significant uncertainty regarding the

Company’s ultimate ability to recover such assets, a valuation allowance is recorded to reduce the assets to its estimated realizable value.

(In millions of Korean won)