Samsung 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154

|

|

109

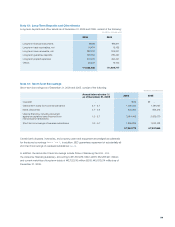

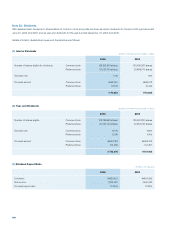

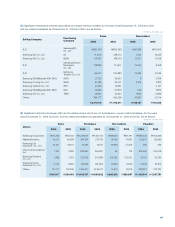

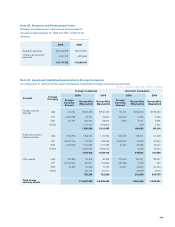

(D) Dividend Yield Ratio

2006 2005

Common Stock Preferred Stock Common Stock Preferred Stock

Dividend per share \5,500 \5,550 \5,500 \5,550

Market price ¹611,400 486,000 644,600 486,100

Dividend yield ratio 0.90% 1.14% 0.85% 1.14%

¹ The average closing price for the prior week from 2 trading days before closing date of shareholders’ list.

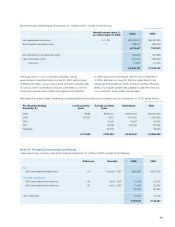

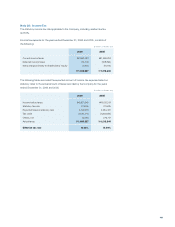

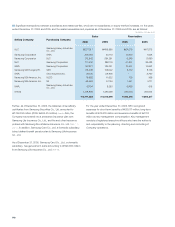

Note 23 : Treasury Stock

As of December 31, 2006, the Company holds 18,540,684 common shares and 2,579,693 preferred shares as treasury stocks recorded

as a capital adjustment.

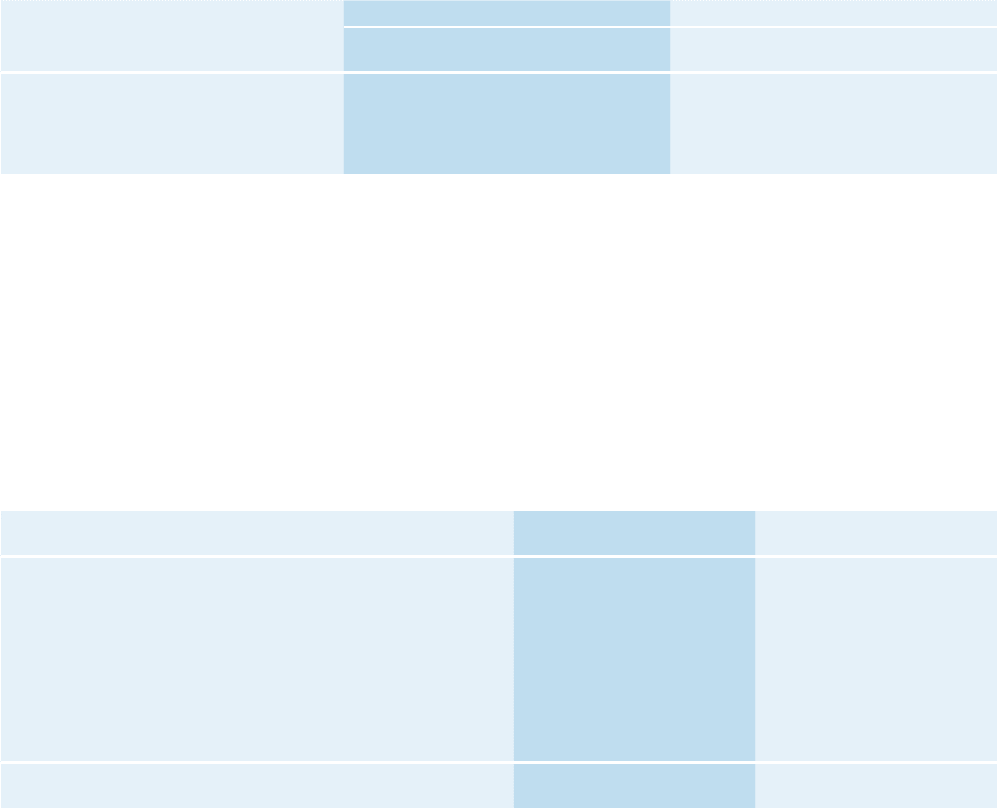

Note 24 Other Capital Adjustments

Other capital adjustments as of December 31, 2006 and 2005, consist of the following:

2006 2005

Gain on valuation of available-for-sale securities \733,050 \559,881

Loss on valuation of available-for-sale securities (1,933) (23,540)

Gain on valuation of equity-method investments 141,958 123,384

Loss on valuation of equity-method investments (43,887) (63,969)

Stock option compensation 539,152 616,824

Cumulative translation adjustments (293,812) (149,618)

Others (15,895) 10,103

\1,058,633 \1,073,065

(In millions of Korean won)

(In millions of Korean won)