Samsung 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

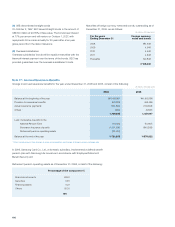

Of the amounts charged to capital adjustments from the valuation

of interest rate swap contracts, a gain of \380 million will be

realized by December 31, 2007.

(I) As of December 31, 2006, the Co riat A L’Energie Atomique,

02 Micro International Limited, St.Clair Intellectual Property

Consultants Inc., Tadahiro Ohmi, Rambus Inc., Sony Ericsson

Mobile Communications Inc., Orion IP, LLC., Agere systems Inc.,

Fujinon Corporation, Inter Digital Communications Corporation,

ON Semiconductor Corporation and Hitachi Global Storage

Technologies Netherlands B.V. for alleged patent infringements,

and as a plaintiff in six overseas legal actions against Compal

Electronics Inc., International Rectifier Corporation, Matsushita

Electric Industrial Co., Ltd, Rambus Inc., Sony Ericsson Mobile

Communications Inc., and ON Semiconductor Corporation for

alleged patent infringements.

Domestic legal actions involving SEC include seven cases as

the plaintiff with total claims amounting to approximately \9,575

million and 25 cases as the defendant, excluding the Samsung

Motors Inc. case, mentioned in (L), with a total claims amounting

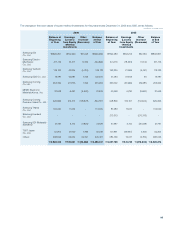

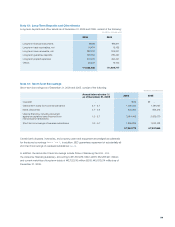

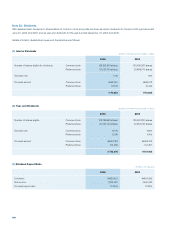

The minimum lease payments and their present value as of December 31, 2006 and 2005, are as follows:

2006 2005

Minimum lease

payments

Present

values

Minimum lease

payments

Present

values

Within one year \4,386 \3,833 \4,346 \3,929

From one year to five years 17,544 14,575 17,384 15,716

More than five years 43,420 24,212 49,802 28,323

65,350 \42,620 71,532 \47,968

Present value adjustment (22,730) (23,564)

Financing lease liabilities \42,620 \47,968

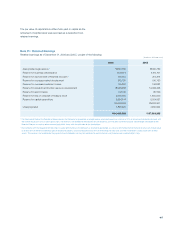

(F) As of December 31, 2006, the Company has various lease

agreements that are recognized as operating leases. Related rental

payments amounting to \61,188 million (2005: \59,646 million)

are charged to current operations for the year ended December

31, 2006.

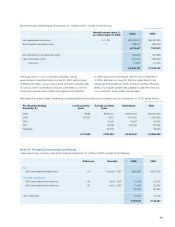

The minimum lease payments as of December 31, 2006 and 2005,

are as follows:

2006 2005

Within one year \59,156 \44,441

From one year to five years 133,373 110,806

More than five years 51,418 73,704

\243,947 \228,951

(G) As of December 31, 2006, the Company has credit insurance

against its approved foreign customers on behalf of its affiliates

and subsidiaries with Korea Export Insurance Co.

(H) As of December 31, 2006, the Company has forward

exchange contracts to manage the exposure to changes in

currency exchanges rates in accordance with its foreign currency

risk management policy. The use of foreign currency forward

contracts allows the Company to reduce its exposure to the risk

that it may be adversely affected by changes in exchange rates.

In addition, the Company has interest rate swap contracts and

foreign currency swap contracts to reduce the impact of changes

in floating rates on long-term debt and borrowings, and interest

rate swap contracts and foreign currency swap contracts to

reduce the impact of changes in the fair-value risk on fixed rate

long-term debt.

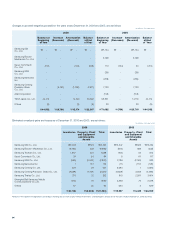

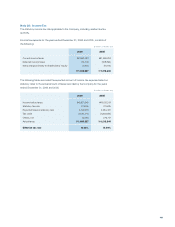

A summary of derivative transactions as of and for the year ended

December 31, 2006 and 2005, follows:

(In millions of Korean won)

(In millions of Korean won)

2006 2005

Type Asset

(Liability)

Gain

(Loss) on

Valuation

(I/S)

Gain

(Loss) on

Valuation

(B/S)

Asset

(Liability)

Forward

exchange \6,319 \7,210 \ - \5,704

(8,866) (9,667) - (7,361)

Interest rate

swap \1,851 \ - \1,673 \9,228

(3,876) - (3,669) (6,202)

Currency

swap \ - \ - \ - \ -

(28,948) (23,468) - (5,480)

(In millions of Korean won)