Samsung 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

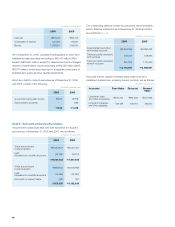

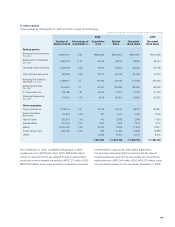

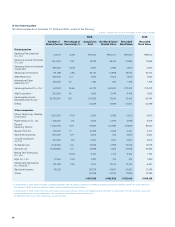

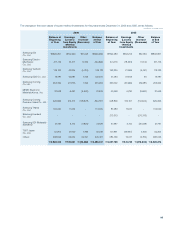

2) Non-listed equities

Non-listed equities as of December 31, 2006 and 2005, consist of the following:

2006 2005

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition

Cost

Net Book Value/

Market Value

Recorded

Book Value

Recorded

Book Value

Related parties

Samsung Petrochemical

Co., Ltd. 514,172 12.96 \8,040 \35,477 \8,040 \8,040

Samsung General Chemicals

Co., Ltd. 1,914,251 3.91 19,143 29,415 13,865 13,865

Samsung Venture Investment

Corporation 980,000 16.33 4,900 5,836 4,900 4,900

Samsung Life Insurance 131,588 0.66 92,112 51,909 92,112 92,112

iMarketKorea Inc. 380,000 14.1 1,900 5,754 1,900 1,900

International Cyber

Marketing, Inc ¹450,000 45 1,166 325 1,166 1,166

Samsung Everland Co., Ltd. ¹641,123 25.64 64,112 450,975 270,313 270,313

Allat Corporation ²300,000 30 1,500 3,476 3,476 1,892

Samsung Electronics

Manufacturing (UK) Ltd. ¹56,730,000 100 103,482 70,194 40,152 35,764

Others - - 24,228 17,628 13,005 22,789

Other companies

Kihyup Technology Banking

Corporation 1,000,000 17.24 5,000 6,356 5,000 5,000

Pusan Newport Co., Ltd. 1,135,307 1.31 5,676 5,008 5,676 5,676

Renault

Samsung Motors ²17,512,000 19.9 87,560 127,680 127,680 87,560

Bluebird Soft Inc. 140,000 17 10,199 2,249 2,441 2,441

SkyLife Broadcasting 600,000 0.71 3,344 482 3,000 3,344

Yong Pyong Resort

Co. Ltd. 400,000 1.05 2,000 1,184 2,000 2,000

TU Media Corp. 3,015,195 6.9 15,076 2,858 15,076 15,076

Symbian Ltd. 10,359,926 4.5 31,839 7,842 31,839 31,839

Beijing T3G Technology

Co., Ltd. - 16.26 9,164 1,745 9,164 7,732

Mybi Co., Ltd. ²72,000 2.43 1,080 312 312 1,080

MasterCard International

Inc. (Class B) ²201,269 0.15 2,241 12,152 12,152 5,467

Bad bank Harmony 68,278 - 68,278 47,931 47,931 11,439

Others 53,799 16,764 17,990 13,755

\615,839 \903,552 \729,190 \645,150

¹ As of December 31, 2006, these investments in affiliated companies were not valued using the equity method of accounting due to the immateriality of their total asset balances or

the Company’s inability to exercise significant influence over the operating and financial policies.

² As of December 31, 2006, certain investments which were valued at acquisition cost due to lack of reliability of basic information up to December 31, 2005, have been valued at fair

value using evaluation results from independent stock evaluation institution (Korea Investors Service, Inc.).

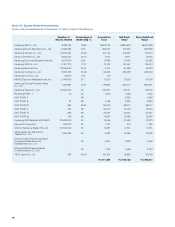

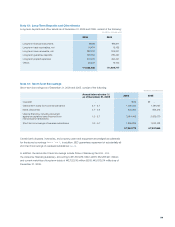

The following are the results of non-listed equities valued at fair value.

(In millions of Korean won, except for the number of shares and percentage)