Samsung 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

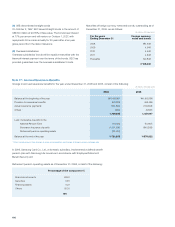

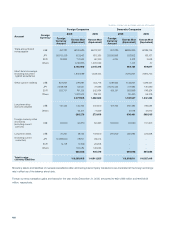

¹ The exercise price can be adjusted in the case of the issuance of new shares, stock dividends, stock splits, or stock mergers.

² The options can be fully vested after two years from the date of grant.

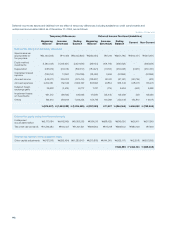

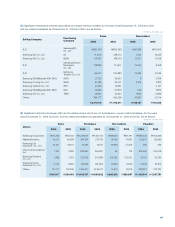

The fair value of each option grant was estimated using the Black-Scholes option-pricing model based on the date of the grant using the

following assumptions:

Date of the Grant

March

16, 2000

March

9, 2001

February

28, 2002

March

25, 2002

March

7, 2003

April

16, 2004

October

15, 2004

December

20, 2005

Risk-free interest rates 9.08% 6.04% 5.71% 6.44% 4.62% 4.60% 3.56% 4.95%

Expected stock price volatility 69.48% 74.46% 64.97% 64.90% 60.08% 43.09% 42.46% 32.71%

Expected life 4years 4years 3years 3years 3years 3years 3years 3years

Expected dividend yield 0.39% 0.89% 0.73% 0.74% 1.25% 0.73% 0.99% 1.14%

The compensation expense related to stock options amounted

to \16,470 million for the year ended December 31, 2006, and is

estimated to be \780 million in total for future periods.

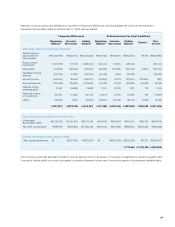

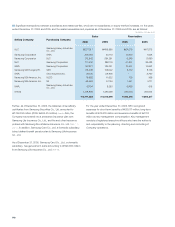

As of December 31, 2006, Samsung Card Co,. Ltd., a domestic

subsidiary, has granted 120,472 shares including 45,472 shares,

which had been granted by Samsung Capital Co., Ltd. as part of

the merger in 2004. However, 602,395 shares in stock options,

which were granted as of December 31, 2005, were adjusted to

reflect issuance of new shares of five to one so that the number of

shares granted is decreased and exercise price is increased. The

compensation expense recognized by Samsung Card Co., Ltd.

was \2 million for the year ended December 31, 2005. The stock

options of \1,231 million according to the SEC’s ownership ratio

are included in a separate component of shareholders’ equity as

other capital adjustments.

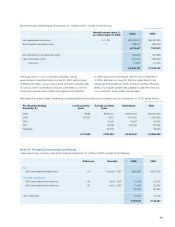

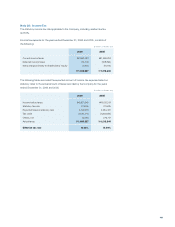

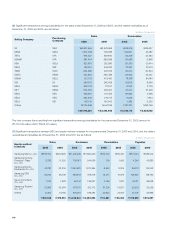

Note 25 : Stock Option Plan

SEC has a stock option plan that provides for the granting of stock purchase options to employees or directors who have contributed or

are expected to contribute to the management and technological innovation of SEC.

A summary of the terms of stock options granted is as follows:

Date of the Grant

March

16,2000

March

9, 2001

February

28, 2002

March

25, 2002

March

7, 2003

April

16, 2004

October

15, 2004

December

20, 2005

Quantity net of forfeitures and exercises 918,656 1,032,600 596,578 84,982 250,790 560,649 7,200 10,000

Exercise price ¹\272,700 \197,100 \329,200 \342,800 \288,800 \580,300 \460,500 \606,700

Exercise period from the date of the grant ²3~10years 3~10years 2~10years 2~10years 2~10years 2~10years 2~4years 2~10years